we

believe

that every business, however small, should have easy access to affordable trade credit.

we

are

a platform where transactions between buyers and sellers are digitally authenticated, thereby allowing banks & institutions to lend with reduced risk, lower costs, and no extra investment or change in process for anyone.

we

create

Affordable credit programs structured with Banks & Institutions for companies at every level of the supply chain, based on their ongoing trade relationship with a larger, more creditworthy entity.

our numbers

speak for themselves

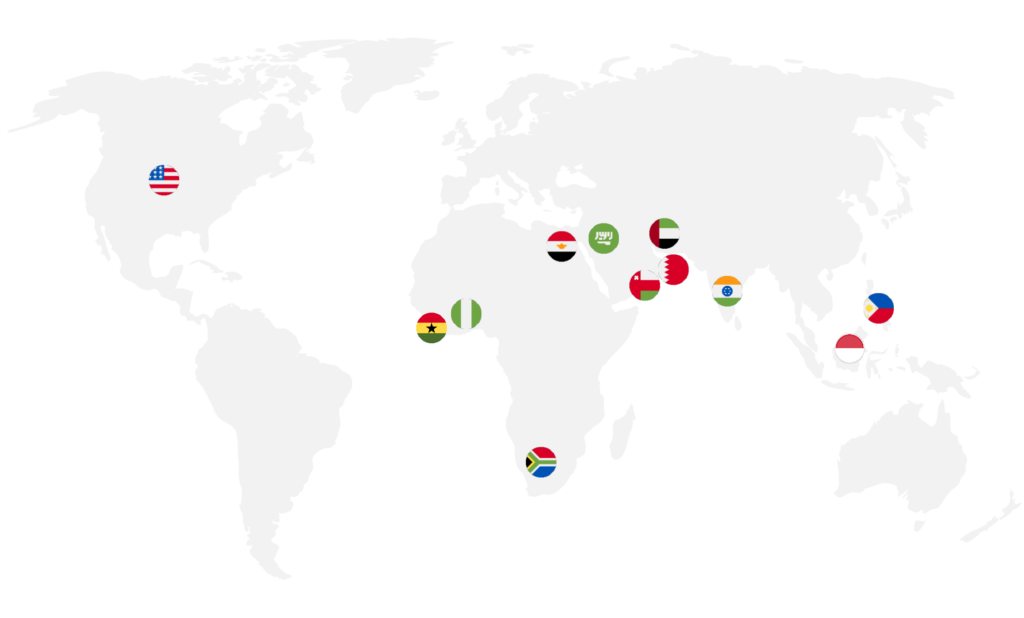

Network Presence