In today’s unpredictable business environment, one overlooked signal can spiral into a massive financial and reputational setback. Yet, across industries, CFOs and Financial Leaders continue to rely more on optimism than data when assessing counterparties, especially MSMEs and dealers who form the backbone of the supply chain.

A recent real-world example tracked by Rubix Data Sciences shows exactly how a seemingly manageable ₹30 lakh exposure snowballed into a ₹25 lakh loss, simply because documented early warnings were ignored. This level of exposure could happen to any organization. But it doesn’t have to.

When Good Intentions Override Hard Intelligence

A leading agrochemical company partnered with Rubix to strengthen its Credit Risk Assessment framework. One of their dealers was immediately flagged as ‘Above Average Risk’ with visible signs of capital stress. Early alerts were available. Signals were documented.

But optimism prevailed. Internal confidence in the long-standing relationship overshadowed objective data. And a 60-day credit line worth ₹30 lakh was approved.

This is where risk management breaks, not because the tools fail, but because human judgment falters in the face of hard intelligence.

When the Warning Signs Arrived, It Was Already Too Late

Over the next two quarters, the dealer’s profile continuously deteriorated, triggering multiple red flags within the Rubix ecosystem:

- GST compliance score dropped sharply

- The Rubix Risk Grade moved to ‘High Risk’

- Continuous stress indicators triggered automated Early Warning alerts

- Compliance Monitoring flagged irregular filings and delays

Despite these clear, systematic signals, engagement and credit extension continued unaltered. Finally, payments stopped cold. More than ₹25 lakh remained outstanding, putting nearly 83% of the transaction value at risk.

In short: The cost of ignoring intelligence far exceeded the cost of acting early.

Your Supply Chain is only as Strong as its Weakest Counterparty

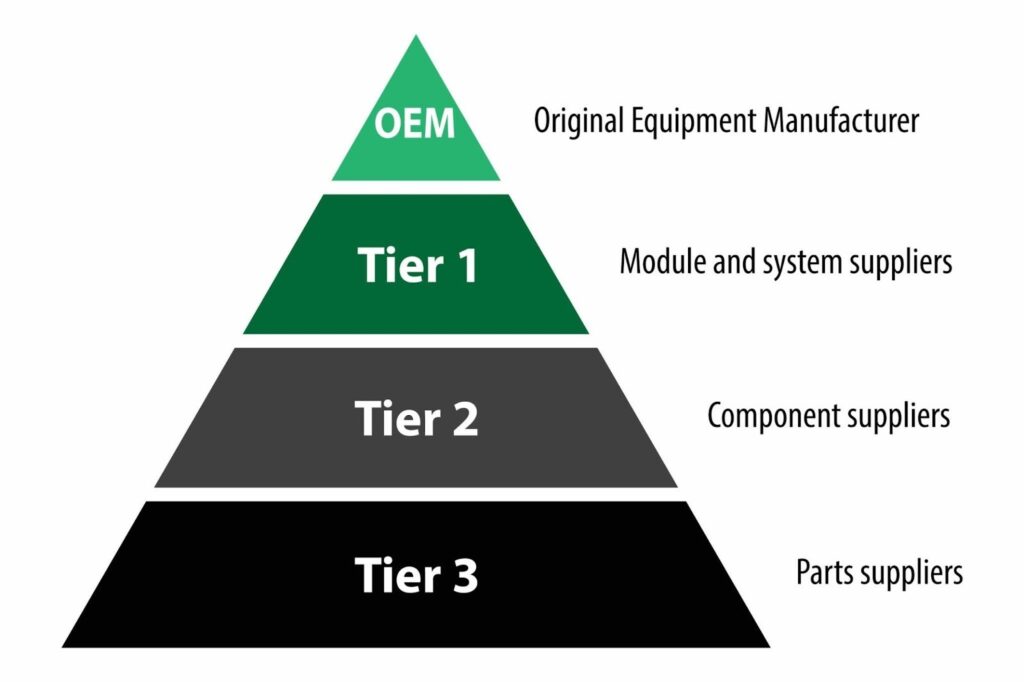

CFOs often track Tier-1 partners closely, yet the real vulnerabilities like liquidity stress, governance gaps, and compliance slippage, frequently emerge in Tier-2 and Tier-3 relationships.

This is where Supply Chain Risk Management must go deeper than just checking annual balance sheets and relying on personal comfort with a counterparty.

Today’s CFO needs intelligence that drives pre-emptive action:

- Real-time health monitoring of all partners

- Automated alerts on financial, legal, GST, and compliance signals

- Strengthened SME Credit Assessment tools for dealers and distributors

- Transparent visibility into ownership and linkages

- A credit lens powered by consolidated structured and unstructured data

Anything less, is expensive guesswork!

The Lesson: Risk Doesn’t Announce Itself, but Data does

The most expensive risks are often those you thought you understood. This case study reminds CFOs of three core principles for resilient financial strategy:

- Early signals matter more than late reactions: Deterioration begins on paper long before it appears as a payment default.

- Optimism is not a control mechanism: Decisions must be grounded in objective Credit Risk Assessment, not personal comfort or historical luck.

- Compliance Monitoring is no longer optional: GST delays, ROC filings, and litigation updates are not noise; they are leading indicators of future financial instability.

Rubix Helps You Act Before Risk Becomes Loss

With Rubix’s integrated intelligence ecosystem, including the Rubix ARMS™ platform, the Early Warning System (EWS), Nexus Check, SME Income Estimation model, and Compliance Monitoring; businesses can detect financial distress early, adjust exposure proactively, and protect both precious capital and hard-won corporate reputation.

The question isn’t whether risk exists in your ecosystem. The question is whether you will see it in time.

In a world where supply chains are volatile, lenders are cautious, and defaults are rising, is it worth risking your partnerships, your cashflow and your reputation, when the early warning signs are already in front of you? Don’t just manage risk. Anticipate it. Act on it. Stay ahead of it.