Supply Chain Finance solutions to optimize working capital and improve cash flow.

Supply Chain Finance solutions to optimize working capital and improve cash flow.

$0Bn+

Financing facilitated

0K+

MSMEs engaged

0+

Supply chains covered

0+

Corporates covered

0+

Cities in India

For Corporates

Discover our Payables and Receivables programs

Single platform for all SCF Programs

Predictable cashflows

20+ major Financial Institutions

Maximum reach and program adoption

For FIs (Financial Institutions)

Discover our comprehensive SCF suite

Cloud-based digital infrastructure

From Loan Origination to Risk Management

Corporate Origination and Network Services

Efficient integration with Corporates

Loan Origination System

Streamlined Applications & Flexible Credit Assessment

Swift approvals and loan processing

Instant updates on application status

Secure document and data access

Scalable and growth-ready platform

Transaction Platform

Efficient Financing with Simplified Connectivity

Unified SCF platform

Rapid fund disbursement facilitation for FIs

Standardized data & automated validations

Real-time tracking and audit trail

Limit Management System

Cloud-based Limit Management for Lower Capex

Invoice-level loan tracking

Automates interest calculations

Monitors credit limits in real-time

Provides actionable insights and analytics

Testimonials

What partners and clients say

Testimonials

What partners and clients say

Frequently Asked Questions

Find quick answers to your

Supply Chain Finance queries.

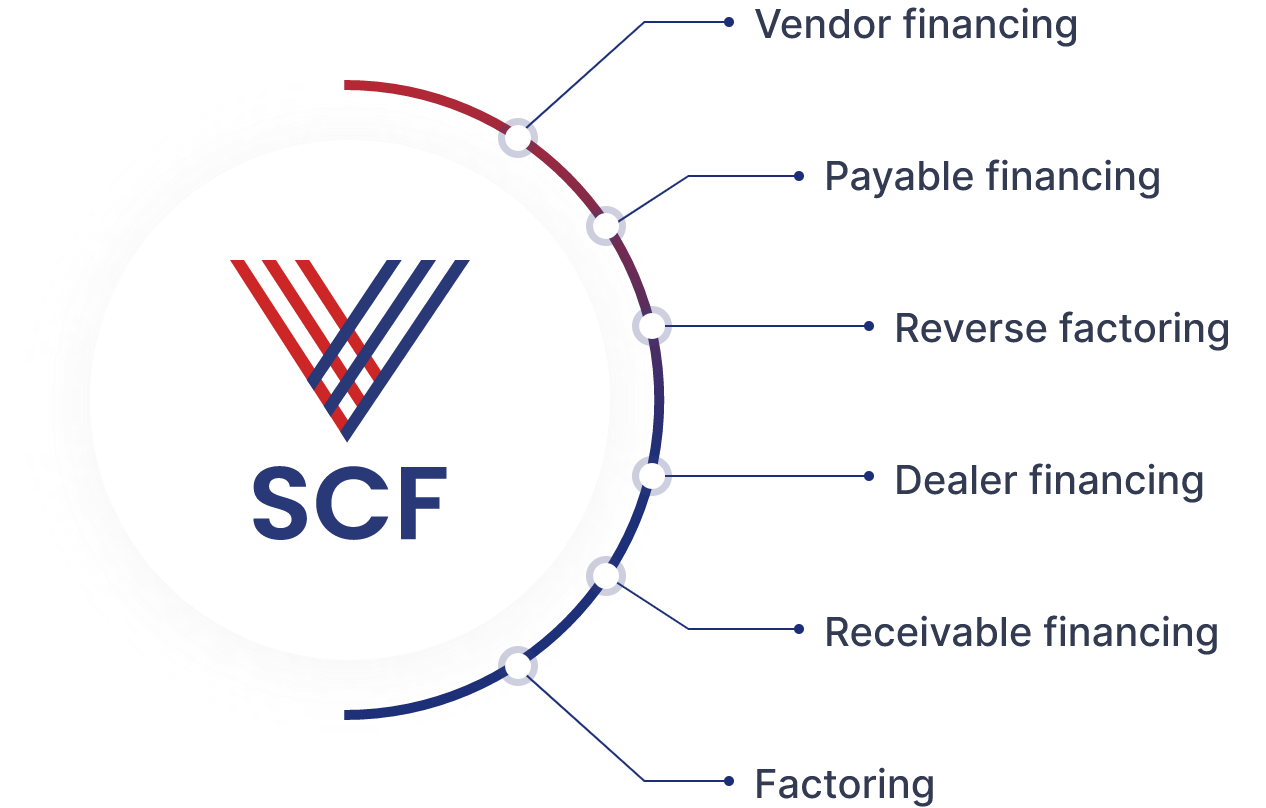

Supply Chain Finance (SCF) refers to a set of technology-led financing solutions that optimize working capital across the entire supply chain, both upstream (receivables) and downstream (payables). It enables buyers to extend payment terms while giving suppliers access to early payments. On the other side, suppliers can offer early payment terms to their buyers and get financed against their receivables. SCF enhances liquidity, strengthens supplier-buyer relationships, and builds resilient supply chains.

The primary parties in Supply Chain Finance (SCF) include the buyer, supplier, and the financial institution providing the financing. Additionally, fintech enablers like Vayana play a crucial role by providing the technology and infrastructure that connect all parties, streamline processes, and scale the SCF program efficiently.

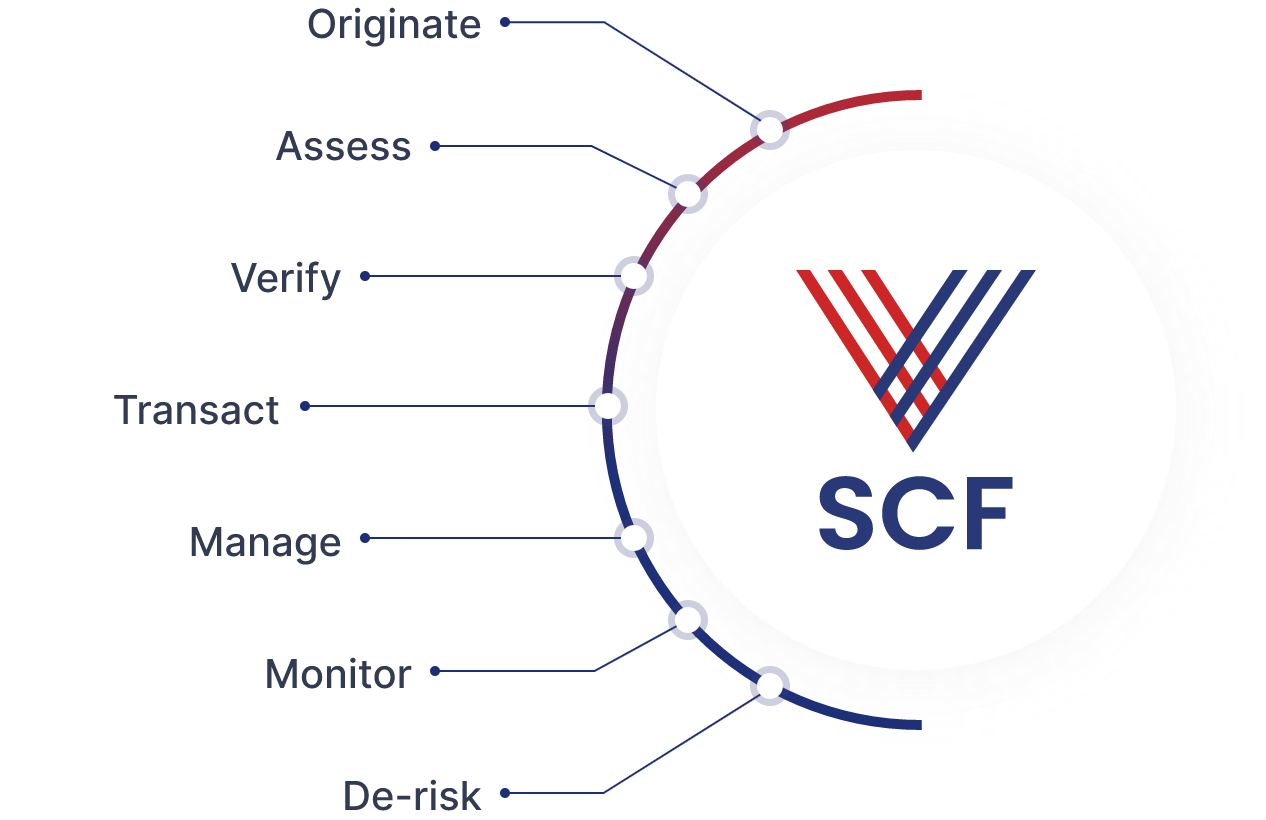

Vayana plays a pivotal role as the technology enabler and program orchestrator in Supply Chain Finance (SCF).

For FIs, Vayana provide the infrastructure to launch, manage, and scale SCF programs easily, including onboarding, compliance, and end-to-end visibility.

For Corporates and SMEs, we offer a single platform to access a wide range of SCF programs across the entire supply chain, along with automation for invoice uploads, approvals, reconciliation, and real-time tracking.

Suppliers benefit from SCF by gaining quicker access to working capital, reducing the need for expensive short-term financing, and mitigating payment risk. They can also negotiate better terms with buyers.

Buyers can benefit from SCF by optimizing their working capital, improving relationships with suppliers, and potentially negotiating discounts for early payments. It also enhances the overall stability of the supply chain.

SCF is used by businesses of all sizes. Large corporates often implement SCF programs to enhance their supply chains, but the programs can be tailored to meet the needs of smaller enterprises as well.

SCF shares similarities with factoring and invoice discounting, but it’s a broader concept that focuses on optimising the entire supply chain’s financial health. Factoring and invoice discounting primarily involve selling receivables to a third party.

Yes, SCF programs are often tailored to meet the specific requirements of a supply chain. The financing terms and conditions can be adjusted to accommodate the unique dynamics of each supply chain.

To implement SCF, you can start by identifying a partner who understands both your business goals and your supply chain dynamics. Financial institutions and enablers like Vayana can help you set up the right SCF program, be it for payables, receivables, or both.

At Vayana, we make it simple to launch and scale SCF across your ecosystem with program design tailored to your supply chain structure and working capital needs, easy onboarding for corporates and counterparties, and access to a wide network of FIs.

Yes, SMEs benefit significantly from SCF — it ensures they get paid on time, improves liquidity for day-to-day operations, and helps build stronger, more reliable relationships with the large corporates they work with.

Key performance indicators (KPIs) for SCF success include improved days payable outstanding (DPO), days sales outstanding (DSO), and supplier satisfaction. An effective SCF program can also be assessed by its impact on working capital.