CFO Mindset and Strategies

5 Proven Practices CFOs Rely on to Accurately Predict Cash Flows

In uncertain markets, even profitable businesses can face liquidity pressure, if cashflows are unpredictable. Only 2% of CFOs have full confidence in their organization’s view of cashflow, a figure that hasn’t improved in recent years.

For CFOs, precision in forecasting cash inflows and outflows is no longer optional; it determines an organization’s ability to invest, operate, and grow without unnecessary financial strain. To achieve this precision, leading CFOs are redefining how they manage working capital, deploying technology, and leverage supply chain finance.

Here are five proven practices that drive accurate and actionable cash flow forecasts.

1. Establish Real-Time Cashflow Visibility

Most CFOs today rely on fragmented reports from multiple departments and banking systems, often leading to outdated or incomplete insights. Research reveals that finance teams spend up to 40% of their time consolidating data from disparate sources, time that could be redirected toward strategic analysis.

The first step toward forecast accuracy is gaining a real-time view of liquidity across all accounts, business units, and geographies. Integrated dashboards and automated data feeds help finance leaders view payables, receivables, and funding positions immediately, allowing them to make quicker, better-informed decisions about short-term liquidity and long-term capital allocation.

Solutions like Vayana Vantage are helping CFOs achieve this visibility, bringing together data from banks, ERP systems, and financing programs into one intuitive dashboard for real-time cash position monitoring.

2. Link Working Capital Metrics with Business Operations

Forecasting accuracy improves dramatically when finance teams align their working capital management with day-to-day business activities. Instead of tracking Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), or inventory cycles in isolation, CFOs now correlate these metrics with production schedules, sales trends, and procurement cycles.

This operational linkage ensures forecasts reflect business realities rather than static financial models. For example, adjusting credit terms during seasonal demand peaks or syncing supplier payments with inventory turnover can significantly smoothen cash flows.

Companies have started to integrate working capital metrics with operational planning to reduce forecast variance. This integration also enables finance teams to identify bottlenecks earlier, such as delayed customer payments or inventory buildups, and take corrective action before they impact liquidity.

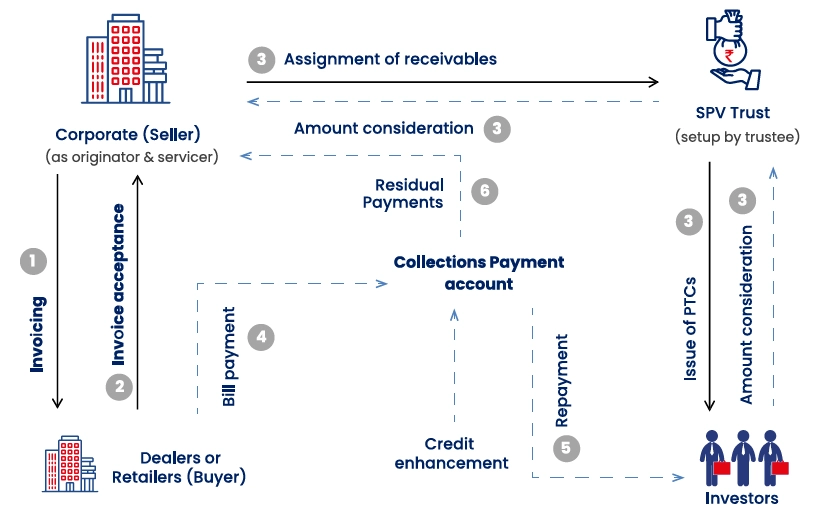

3. Leverage Supply Chain Finance for Predictability

Supply Chain Finance (SCF) is emerging as a strategic lever, not just for liquidity but for forecasting stability. The global SCF market, valued at over $12.47 billion in 2024, is expected to grow at a CAGR of 8.6% through 2029, reflecting its increasing adoption by forward-thinking CFOs.

By integrating SCF programs into the planning process, CFOs can anticipate inflows and outflows linked to Vendor Payments, Dealer Collections, Early Settlements, and Funding Cycles. When Suppliers or Dealers opt for early payments through SCF, the resulting data flow gives CFOs better visibility into payment timing and counterparty behavior, enabling more confident forecasts and reduced volatility in cash positions.

Here’s what one of the CFOs transacting on Vayana’s platform has to say about SCF as a strategic lever: “Before adopting Vayana’s (SCF) solution, we faced challenges with managing payment cycles and optimizing working capital. The transparency and real-time insights through Vayana’s interface have been particularly valuable. We can now track and manage our payables with ease, making informed decisions that align with our financial strategy.” – General Manager of a Leading FMCG Conglomerate.

4. Automate Reconciliation and Forecast Adjustments

Manual reconciliation is one of the biggest barriers to real-time forecasting. The typical finance team spends 15-20 hours per week on manual data reconciliation. According to industry benchmarks, a process is prone to errors that cascade into forecast inaccuracies.

Automation tools now match payments, invoices, and receipts across multiple systems within seconds, reducing lag and eliminating human error. Automated forecast adjustments, based on live transaction data, allow finance teams to instantly reflect changing market or operational conditions in their projections. The result is a continuously updated and highly reliable cash flow model.

Vayana Vantage – The CFO’s Control Tower, simplifies this further by integrating data flows from SCF programs and financial systems, giving CFOs a unified, automated view of reconciled cash positions.

5. Integrate Risk and Scenario Planning into Forecast Models

Cash flow prediction isn’t just about tracking numbers; it’s also about anticipating change. In today’s volatile environment, marked by geopolitical tensions, supply chain disruptions, and fluctuating demand patterns, 73% of CFOs say traditional forecasting methods are insufficient for managing uncertainty (EY Global CFO Survey).

CFOs increasingly integrate Risk Analytics into their forecasting tools to model potential disruptions such as supplier defaults, delayed receivables, or demand fluctuations. Scenario-based planning enables them to assess the impact of these variables and prepare alternate funding or liquidity strategies well in advance.

Leading organizations run multiple scenario models simultaneously, stress-testing their cashflows against best-case, worst-case, and most-likely outcomes. This agility ensures resilience even in volatile market conditions and provides boards with the confidence that liquidity risks are actively managed.

The CFO’s View: From Forecasting to Foresight

Accurate cash flow forecasting empowers CFOs to make strategic, data-driven decisions. By combining real-time visibility, automation, and collaborative planning, finance leaders can transform forecasting from a routine exercise into a competitive advantage.

Vayana, with over 15 years of expertise in supply chain finance and working capital management, helps organizations unlock liquidity and optimize cashflows across their operations. By leveraging SCF programs, CFOs can manage payables and receivables more predictably, accelerating payments to suppliers, extending working capital where needed, and reducing dependence on short-term borrowing.

Vayana Vantage – A CFO Dashboard, further enhances this by consolidating data from all partner banks, systems, and counterparties into a single, intuitive dashboard. It gives CFOs real-time visibility into funding cycles, invoice status, and liquidity positions, enabling smarter decisions and faster responses to be changing business conditions. With Vayana, CFOs can turn forecasting into foresight, improving financial agility, mitigating risks, and ensuring the business is always prepared for what comes next.

To know more about Vayana Vantage, write to scf-enquiries@vayana.com