Supply Chain Risk Assessment

Anticipating Credit Risk and Default by Trade Debtors: How Early Warning Systems Can Protect Your Business

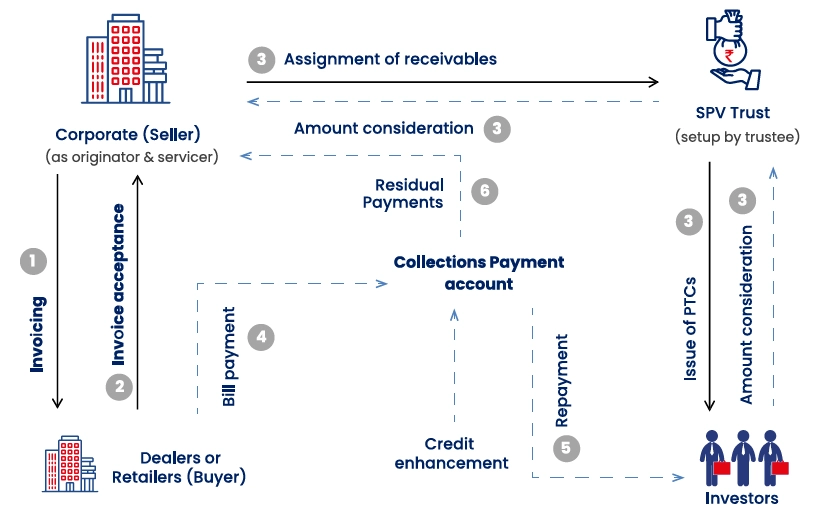

Credit risk management is a paramount concern for CFOs. Unreliable trade debtors, or customers who fail to meet their payment obligations, can pose a significant financial threat. Fortunately, a powerful tool exists to mitigate these risks: Early Warning Systems (EWS). These data-driven platforms continuously monitor trade debtors, providing you with the ability to identify potential problems at an early stage. This proactive approach allows for timely intervention and minimises potential losses.

The Limitations of One-Time Credit Assessments

Solely relying on a credit check conducted at the outset of a business relationship is insufficient. A company’s financial health can fluctuate significantly over time. An entity that was a low credit risk two years ago might be your biggest credit risk today. Your most critical supplier from a year ago may be on the verge of bankruptcy. An EWS addresses this limitation by providing continuous monitoring, ensuring you have access to up-to-date insights into the financial well-being of your counterparties: suppliers, vendors, customers, distributors, franchisees, or even competitors.

Early Warning Signals: Identifying Potential Risks

Effective EWS platforms track a comprehensive range of indicators that can signal potential trouble with trade debtors. These indicators can be broadly categorised as follows:

- Financial Indicators: Negative cash flows, extended payment delays, high borrowing costs, and significant deviations from industry benchmarks in financial data can be causes of concern

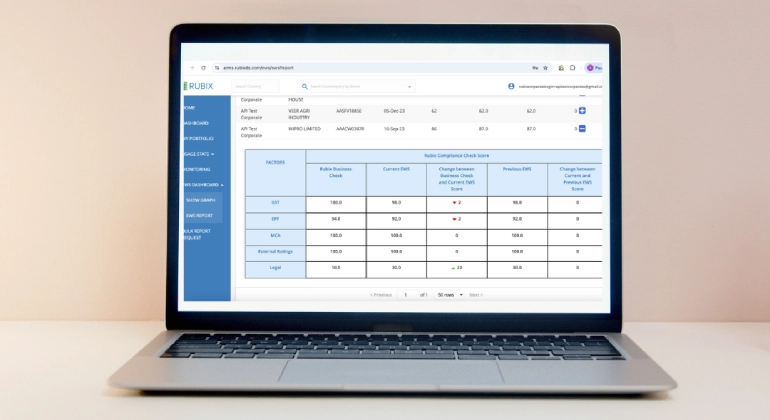

- Compliance Indicators: Companies experiencing financial strain often neglect statutory obligations. For Indian entities, monitoring filings with regulatory bodies like the Goods and Services Tax (GST) and the Ministry of Corporate Affairs (MCA) can identify potential compliance issues. Checking Employee Provident Fund (EPF) filings can reveal irregularities related to employee payments or sudden workforce reductions (indicating layoffs)

- Legal Indicators: A rise in lawsuits against a company, such as those related to bounced checks or labour disputes, can be a sign of deeper financial problems

- Perception Indicators: Social media can be a valuable source of insights. Negative customer reviews, high employee turnover, or sudden changes in leadership within a family-owned business can all be red flags

- Credit Ratings: Regularly monitoring credit ratings assigned by external agencies is crucial. A downgrade in credit rating necessitates a closer look at the company’s situation

- Industry and Geopolitical Indicators: Economic downturns or supply chain disruptions within a specific industry can negatively impact your customers. Similarly, global events like wars or political crises can have unforeseen consequences

The Impracticality of Manual Monitoring

While these indicators are valuable, relying solely on manual monitoring is impractical. Gathering data from various sources is labour-intensive and time-consuming. Additionally, analysing data in isolation does not provide the holistic view necessary for effective risk assessment.

The Power of Data-Driven EWS

Modern EWS platforms leverage technology to revolutionise credit risk management. These platforms can automatically collect and analyse data from a multitude of sources, including public records, credit bureaus, news feeds, and internal company data. This comprehensive data is then used to generate dynamic credit scores that reflect the real-time risk profile of your trade debtors.

Furthermore, these EWS platforms are highly customisable. You can tailor the system to your specific needs and risk tolerance by choosing the data sources to monitor, the frequency of updates, and the risk thresholds that trigger alerts.

The Rubix Early Warning System (EWS) platform, for example, is a user-friendly platform designed to provide you with a robust and comprehensive EWS solution. It is a cost-effective, customisable, plug-and-play platform requiring no additional investment in technology with intuitive automated risk scoring and easy-to-understand dashboards.

Modern businesses are operating in a VUCA world where proactive risk management is essential for financial stability. By employing EWS you gain a powerful tool to identify and mitigate risks associated with trade debtors. Benjamin Franklin wisely said, “By failing to prepare, you are preparing to fail.” Implementing an EWS demonstrates a proactive approach to financial security, ensuring your business is well-prepared for whatever challenges the future may hold.