Supply Chain Risk Assessment

Beyond Borders: Securing Your Supply Chain in a World of Shifting Power Dynamics

The entire world had been anxiously awaiting the outcome of the US election, and now, with the results declared, nations and businesses alike are scrambling to prepare for potential shifts in US policy direction. As the world’s largest importer, the US plays a critical role in shaping global trade policies, and any changes in its stance can send shockwaves through international markets. President Trump’s new

administration is likely to usher in protectionist policies and raise tariffs, which will impact trade and intensify the risks faced by global supply chains. Whether it is sanctions, tariffs, or trade route closures, businesses around the world are operating in a volatile business landscape. The shadow of conflict and shifting political alliances now threaten to unravel decades of progress in international trade, seriously affecting countries and businesses. Recent estimates suggest that geopolitical disruptions could cost the global economy up to $14.5 trillion over the next five years.

In such an uncertain business environment, securing supply chains and managing credit risk is no longer optional—it is an imperative for survival. To stay resilient, companies must proactively shield their operations and finances against sudden disruptions, from unstable suppliers to unforeseen credit risks. Let us explore key strategies for securing supply chains against credit and supplier risks in this increasingly unpredictable landscape.

Key strategies for securing Supply Chains against credit and supplier risks

1. Counterparty selection and diversification:

Selecting suppliers in different regions and building a diverse supplier base can reduce vulnerability to sudden regional conflicts, political changes or natural catastrophes. With 90% of global goods transported by sea, the blockage of major routes, as seen with the Suez Canal incident in 2021 or the Red Sea Crisis, underscores the importance of having alternate suppliers in geographically diverse locations. Many companies are now adopting near-shoring strategies, which involve selecting suppliers closer to home to minimise risk. This approach not only secures supply chains but also shortens lead times, enhancing overall resilience.

2. Identity verification and due diligence:

Choosing new suppliers comes with the risk of doing business with unknown partners in unfamiliar regions. Therefore, an identity check is an important step to verify the legitimacy of all counterparties you propose to engage with. This process involves gathering and confirming critical information about the counterparty’s identity, ownership structure, management background, and compliance history. Proper identity checks serve as a protective measure against working with entities involved in illicit activities such as identity fraud, money laundering, or tax evasion. They shield your business from financial and reputational damage and ensure legal compliance. In fact, businesses should go one step further and perform due diligence, which is a comprehensive, systematic evaluation of a potential business partner’s background, financial health, legal standing, and reputation, conducted before entering into any transaction or relationship. This helps in identifying potential financial, operational, and reputational risks early on, helping your company protect itself from costly legal battles, regulatory penalties, and fraud.

3. Designing and deploying a robust credit scoring model and setting credit limits:

Credit decisions can no longer be made by executives depending on their own impression of the counterparty. All credit decisions should be based on data-driven assessments of creditworthiness, and this can be done by designing and deploying Credit Risk Models. Their goal is to calculate Risk Scores for each customer depending on their transaction history, financial statements, statutory compliance, litigation data, data derived from the social media profile of the promoters and management, ownership patterns, trade references, related parties, and customer and employee feedback. Further, credit risk can be mitigated by deploying credit limit-setting models for prudent and systematic credit limit setting. These can be automated to recommend actionable credit limits and terms for customers, distributors, and dealers after calibrating their Risk Scores with the organisation’s credit risk appetite. Automated Risk Management and Monitoring platforms offered by risk intelligence and analytics companies should be used in your credit decisioning process.

4. Supply Chain Finance:

Supply Chain Finance (SCF) is a great way to improve supplier stability, providing them with early payment options and reducing the volatility in their cash flows. SCF programs can ease cash flow constraints of SME suppliers, allowing them to manage their finances effectively and fulfil orders reliably. By collaborating with fintech platforms and financial institutions to roll out SCF programs, you can strengthen your supply chain and enhance supplier stability.

5. Continuous monitoring and predictive analytics:

Implementing continuous monitoring tools provides real-time insights into counterparty risks. This ongoing visibility allows you to respond rapidly to emerging risks, such as changes in customer or supplier financial health or regulatory non-compliance by counterparties. Predictive analytics help in making informed B2B risk decisions, and identifying potential threats before they impact the supply chain. Continuous monitoring ensures a dynamic and proactive approach to risk management, which is essential in an increasingly unpredictable environment.

6. Contingency planning and insurance:

Establishing contingency plans for disruptions is essential for supply chain resilience. Measures such as stockpiling critical materials, diversifying logistics routes, and preparing alternative manufacturing sites enable business continuity amid disruptions. Additionally, credit insurance and Contingent Business Interruption (CBI) insurance are valuable tools in risk management. Credit insurance protects against non-payment by covering potential losses, while CBI insurance shields you from the costs associated with a supplier’s inability to deliver goods due to geopolitical disruptions.

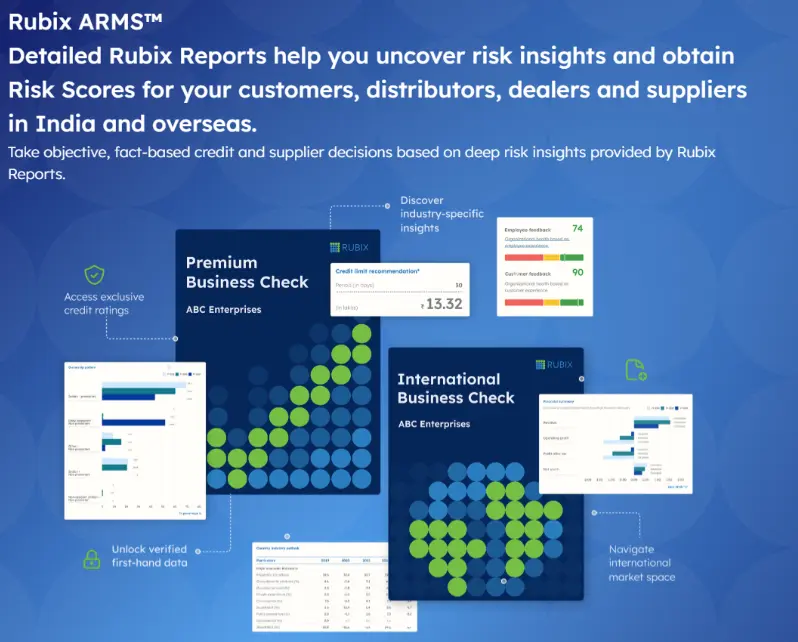

Embrace a proactive approach to counterparty risk management by leveraging Rubix Data Sciences’ suite of solutions which include:

- KYC Solutions for Verifying the Identity of Counterparty Before Onboarding

- Counterparty Risk Assessment using the Rubix ARMS Platform

- Risk Monitoring using the Rubix EWS Platform

Reinforcing resilience amid geopolitical uncertainty

The rising tide of geopolitical instability, from trade tensions to armed conflicts, signals that supply chain disruptions are likely to continue as a recurring challenge. Recent data shows that 76% of European businesses have experienced costly supply chain disruptions in the past year due to geopolitical and climate issues. This reality calls for an approach that goes beyond traditional risk management to include strategic preparation for global uncertainties. If your business is dependent on international trade, cultivating supply chain resilience is not a luxury but a critical necessity.

By prioritising resilience, your company can mitigate risks posed by an increasingly interconnected and competitive world. Embracing a proactive, flexible, and strategic approach to supply chain risk management will allow you to operate with confidence—no matter where the winds of global change may blow.