Case Studies

Empowering Indian Textile Exporters through Vayana TradeXchange

Supplying fabrics, garments, and home textiles worldwide, India’s textile industry plays a key role in the country’s exports and employment, right from the spinning mills of Tirupur to the weaving clusters of Surat and Karur. Together, these exporters serve buyers across the US, Europe, the Middle East, and Southeast Asia.

However, the textile ecosystem faces mounting pressures. India’s textile and apparel exporters are confronting severe disruptions following the US’ imposition of a 50% additional tariff, according to a nationwide survey by the Confederation of Indian Textile Industry (CITI). The US, which accounts for 28% of India’s textile and apparel exports, has become significantly less accessible, eroding competitiveness. Nearly one-third of surveyed exporters reported turnover declines of over 50%. Contributing factors include price discount demands from US buyers, order cancellations or postponements, and reduced order volumes.

Liquidity pressures have risen sharply: 82% of exporters reported longer credit cycles, with many facing payment delays of three to six months. Around 40% said their working capital needs have jumped by over 30%, creating severe cash flow strain across the value chain. More than half of the respondents urged the government to announce a moratorium on existing loan repayments, while 42% recommended collateral-free loans to ease the financial burden.

For many of the 1,200+ SME and mid-sized exporters in India, each order brings both opportunity and uncertainty, with payments often arriving 60 to 120 days after dispatch.

The Challenge: Balancing Growth with Liquidity

While global demand for Indian textiles has held strong, financial access has not kept pace. Exporters face delayed payments, limited export financing options, and high dependence on collateral-based bank credit. Seasonal demand swings amplify the challenge. Peak order periods require more working capital just when cash is tied up in receivables.

Additional pressures include:

- Currency Volatility: Exporters dealing with multiple currencies face unpredictable receivable values. Even a minor depreciation in the Indian Rupee against the US Dollar or Euro can significantly impact profitability.

- Rising Input Costs: The price of cotton, dyes, synthetic fibers, and energy has been increasing steadily, putting additional pressure on already thin margins.

- Manual and Paper-Heavy Processes: Many exporters still rely on traditional documentation and bank processes, leading to delays and operational inefficiencies.

- Export Concentration Risk: With nearly a third of exports directed to the US, policy shifts like tariffs have an outsized effect, highlighting the vulnerability of concentrated markets.

These combined factors often force exporters to either decline new orders, take on high-cost financing, or operate on razor-thin margins, all of which undermine growth potential and limit competitiveness in global markets.

The VTX Solution: Digital ITFS Platform Facilitating Export Factoring Beyond Borders

Vayana TradeXchange (VTX) is an end-to-end digital marketplace that facilitates affordable cross-border trade finance globally. It is registered and regulated by IFSCA (International Financial Services Centre Authority), GIFT City, Gandhinagar, Inida, the unified regulator set up under the IFSCA Act 2019 by the Government of India.

The unique feature of VTX is an auction-based dynamic rate discovery mechanism that helps the participants (exporters and importers) get the best possible discounting rates from multiple financiers across the globe in a currency of their choice, just at the click of a button with no locational constraints.

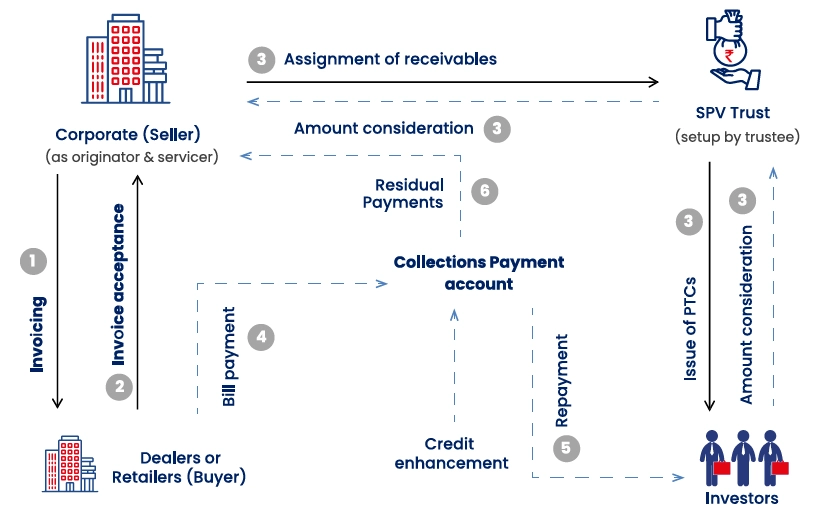

To address the challenges faced by the Indian Textile Industry, Vayana TradeXchange (VTX) introduced a Cross-Border Export Factoring Solution built on its International Trade Finance Services (ITFS) platform. The solution enables exporters to access working capital quickly, turning long receivable cycles into immediate liquidity.

Through non-recourse receivable financing, exporters can unlock funds within days of shipping, eliminating the need to wait for buyer payments and reducing dependence on collateralized credit.

How it works:

- Invoice Upload: Verified invoices are uploaded directly onto the VTX platform.

- Competitive Bidding: Multiple global financiers submit bids, creating a transparent marketplace that ensures competitive financing rates.

- Fast Disbursement: Funds are disbursed digitally within 48–72 hours of bid acceptance, significantly reducing the wait period.

- Seamless FX Conversion: Foreign exchange conversion and settlement are automated, ensuring quick realization in Indian Rupees without manual intervention.

- Automated Compliance: (KYC), (AML) / TBML checks, and e-documentation are automated, maintaining regulatory compliance while minimizing delays.

Through a single automated digital dashboard, textile exporters now have real-time visibility into their receivables and funding status.

VTX Impact: Speed, Savings, and Scalability

The VTX platform has unlocked over USD 20 million in financing for textile exporters across India’s major clusters. For most participants, the turnaround from shipment to cash realization has dropped from approximately 90 days to just 2–3 days, drastically improving liquidity management.

Exporters report multiple benefits, including:

- Lower Financing Costs: Up to 35% savings compared to traditional bank credit.

- Improved Working Capital: Non-collateral financing frees up resources to invest in production, technology, and labor.

- Growth Enablement: With faster access to funds, exporters can accept larger orders, diversify product lines, and explore new markets.

- Transparency and Trust: Shared digital infrastructure ensures all transactions are visible, verifiable, and compliant, strengthening relationships with financiers and buyers alike.

Beyond immediate financial benefits, the VTX platform helps exporters adapt to macroeconomic shocks, such as sudden tariff hikes, fluctuating demand, and currency volatility, by providing predictable, flexible financing solutions.

Read Also – Unlocking Better Working Capital Management Through Trade Finance

Key Takeaways : Building Resilience in a Volatile Global Market

The US tariff disruption reinforces the fragility of concentrated export markets and the importance of resilient financial structures. VTX’s ITFS-based export factoring solution not only addresses cash flow bottlenecks but also equips exporters with the agility to respond to sudden market shifts.

By connecting Indian exporters directly with global financiers, the VTX platform reduces reliance on traditional banking channels, democratizes access to credit, and encourages a more diversified, risk-aware approach to growth.

The initiative goes beyond financing innovation. It marks a step toward a more inclusive, digitally connected trade ecosystem. By giving SMEs and mid-sized exporters the tools to manage working capital efficiently, navigate global disruptions, and expand production sustainably, VTX is helping India’s textile industry weave a stronger, more resilient presence on the world stage. Over time, this could help India’s textile sector reduce its vulnerability to geopolitical shocks, stabilize revenues, and strengthen its position in competitive international markets.