CFO Mindset and Strategies

How Can Companies Manage Margin Pressure in B2B Manufacturing with Working Capital Solutions?

In India’s competitive B2B Manufacturing Sector, even companies showing strong revenue growth often struggle with shrinking margins. Imagine a mid-sized auto component manufacturer in Pune. Over three years, the company has doubled its revenue by securing large OEM contracts. Despite this top-line growth, its EBITDA margins have shrunk steadily. The culprit? Rising input costs, spiralling logistics costs, delayed payments from buyers, and working capital tied up in inventory, all put together eating into profits.

This is not an isolated scenario. Across sectors, manufacturers face mounting margin pressure, driven by external cost escalations and internal inefficiencies. However, companies that pay close attention to managing working capital efficiently are able to buck this trend.

Robust academic research on Indian manufacturing firms has shown that efficient working capital management can have a direct, positive impact on profitability. Companies that optimise their cash conversion cycle and reduce reliance on high-cost borrowing consistently outperform those that don’t.

The Link Between Working Capital and Profitability

In their research paper “Working Capital Management and Profitability: Evidence from Indian Manufacturing Companies”, Singhania, Rohit, and Sharma (2014) analysed a broad sample of firms and found a strong inverse relationship between working capital metrics, such as inventory and receivable days, and Return On Assets (ROA). Simply put, the longer capital is tied up in stock or unpaid invoices, the more it drags down profitability.

Crucially, the authors concluded that profitability peaks not at the lowest level of working capital, but at an optimised one, where liquidity and efficiency are well-balanced. Firms with moderate Cash Conversion Cycles (CCC) were more profitable than those with overly tight or excessively lax cycles.

Another study by Panda and Nanda (2018), “Working Capital Financing and Corporate Profitability of Indian Manufacturing Firms”, reinforced these findings, showing that over-reliance on short-term debt for working capital needs leads to higher financial costs and weaker margins.

Understanding Margin Pressure in the B2B Manufacturing Context

Margin pressure sets in when input costs outpace revenue growth. In B2B manufacturing, where transactions are large, credit cycles are long, and pricing power is limited, this problem is amplified. Payments from buyers, especially large corporations and government entities, often take months, leaving firms to plug cash flow gaps with expensive short-term borrowing.

Add global supply chain disruptions, commodity inflation, and currency fluctuations, and the pressure on margins intensifies. Managing working capital efficiently, therefore, becomes a financial and a strategic imperative.

Working Capital Solutions to the Rescue

So, how can Indian B2B Manufacturers ease this pressure? By adopting structured working capital solutions that unlock liquidity, improve cash flow predictability, and reduce reliance on debt.

Here are some effective strategies for modern CFOs to consider:

1. Supply Chain Finance (SCF)

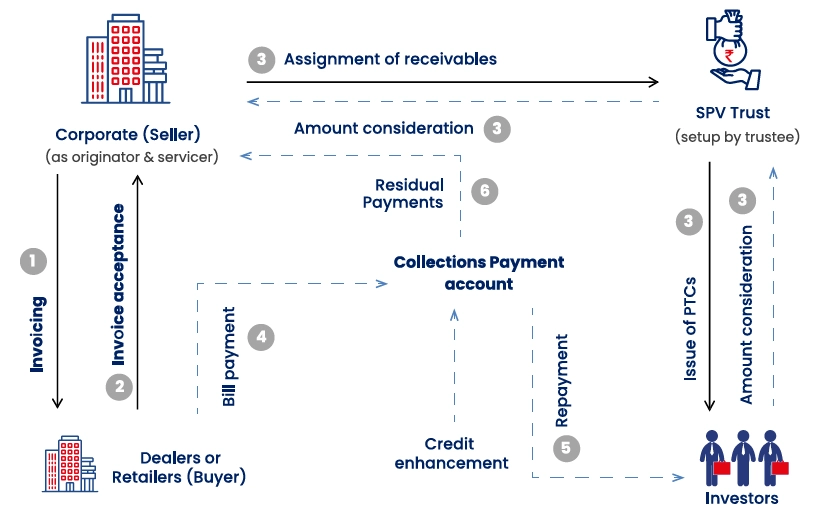

SCF solutions like invoice discounting or factoring, enable manufacturers to receive early payments against receivables, often at rates based on their buyers’ credit profiles. This shortens the cash conversion cycle and provides access to low-cost liquidity; e.g., a company that gets paid in 5 days instead of 60 can reinvest that cash faster, reduce borrowing, and scale operations more efficiently.

2. Inventory Financing

Inventory-heavy businesses can unlock liquidity by using inventory financing solutions wherein businesses obtain short-term loans or lines of credit from financiers using their existing or purchased inventory as collateral. This liquidity allows manufacturers to maintain production momentum while waiting for sales to close.

3. Dynamic Discounting

Through digital platforms, companies can offer early payment discounts (cash discounts) to buyers in exchange for quicker payment. This reduces Days Sales Outstanding (DSO) and strengthens liquidity without increasing debt.

4. Receivables Management and Analytics

Using data & analytics tools to track and manage receivables, help businesses prioritise collections, identify risky accounts, and forecast cash flow needs. Better visibility enables proactive financial planning.

5. Vendor Financing

Just as SCF supports receivables, vendor financing supports payables. It ensures that a company’s suppliers are paid on time (or even early), which helps it to negotiate better procurement terms. Companies that make arrangements to pay their vendors on time are perceived as being reliable buyers, ensuring continued supplies from vendors who prioritize their needs. In this manner, companies that deploy vendor financing are able to protect their margins.

From Stress to Strength

Margin pressure in B2B Manufacturing is a structural challenge in today’s volatile and cost-sensitive environment. However, Indian manufacturers don’t have to rely on traditional approaches alone. Working capital solutions offer a smarter and more efficient way to improve financial resilience and operational flexibility.

Firms that treat working capital management as a strategic lever are better positioned to grow sustainably and competitively.

Platforms like Vayana are helping businesses across the manufacturing value chain access integrated working capital solutions, enabling them to move from financial stress to strength. By combining technology, finance, and strategy, manufacturers can transform working capital into a competitive advantage and protect their margins, even under pressure.