CFO Mindset and Strategies

Optimizing Working Capital with Trade Receivables Securitization: A Strategic Approach to Corporate Finance

In today’s dynamic business environment, working capital optimization has become a critical success factor for companies across industries. As businesses grapple with extended payment cycles, supply chain disruptions, and the need for sustainable growth, traditional financing methods often fall short of meeting evolving corporate needs. Trade Receivables Securitization (TRS) has emerged as a sophisticated financial instrument that addresses these challenges while providing companies with enhanced liquidity management capabilities.

Understanding Trade Receivables Securitization

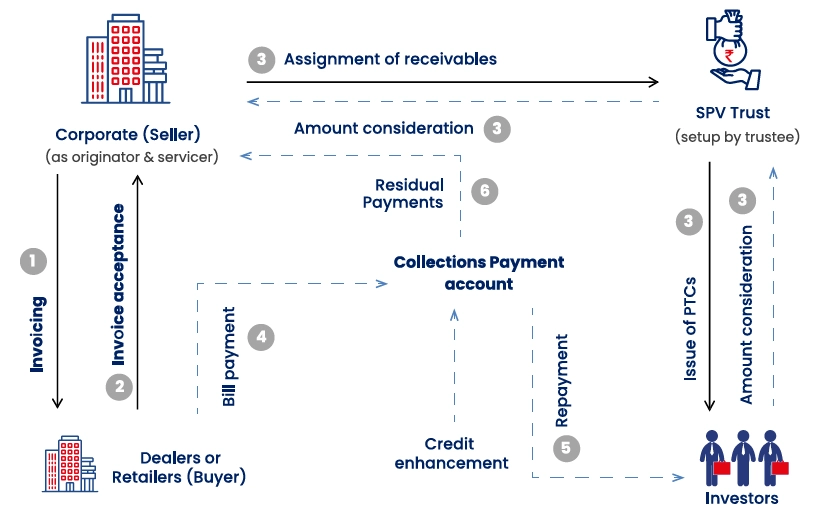

Trade Receivables Securitization is an innovative structured finance solution specifically developed to address two persistent challenges in receivables financing that existing instruments have been unable to resolve. Unlike traditional factoring or discounting, TRS provides large corporates with an efficient and scalable gateway to private capital markets, enhancing both liquidity and funding diversification.

The process involves pooling trade receivables from multiple debtors and transforming them into tradable securities backed by the cash flows from these receivables. What sets TRS apart is its ability to tackle fundamental operational and coverage limitations that have long constrained corporate financing options.

Key Benefits of Trade Receivable Securitization for Working Capital Optimization

1. Solving Operational Burden

TRS provides a single, scalable structure that enables coverage of large debtor portfolios with minimal reconciliation requirements. Unlike traditional receivables financing that demands extensive onboarding processes and ongoing involvement, TRS streamlines operations by eliminating these administrative burdens while maintaining comprehensive coverage.

2. Comprehensive Debtor Coverage

One of TRS’s most significant advantages is its ability to extend financing across a broad spectrum of buyers without requiring individual credit assessments or contractual arrangements. This approach ensures maximum limit utilization while removing the constraints typically associated with debtor-specific financing requirements.

3. Enhanced Financial Flexibility

TRS offers unsecured financing with no recourse to the seller, providing companies with clean balance sheet treatment. The potential for off-balance sheet accounting treatment aligns perfectly with asset-light business models and improves key financial ratios.

4. Operational Efficiency and Speed

The flexible tenor with replenishment model allows for continuous funding as new receivables are generated. Quicker implementation timelines ensure faster access to liquidity compared to traditional financing structures, enabling companies to respond rapidly to market opportunities.

5. Capital Markets Access

TRS serves as an efficient gateway to private capital markets, providing access to diversified funding sources including institutional investors, pension funds, and asset management firms. This diversification reduces dependency on traditional banking relationships while often achieving more competitive pricing.

Real-World Success: FarMart & Vayana Case Study

A compelling example of TRS implementation comes from Farmart Services Pvt. Ltd. and their partnership with Vayana, which demonstrates how innovative companies are leveraging this financial instrument to optimize their working capital.

The Challenge

FarMart, a SaaS-based B2B food commerce platform connecting over 3.8 million farmers and 250,000 farm aggregators across Asia, the Middle East, and Africa, faced critical working capital optimization challenges that existing financing instruments couldn’t adequately address:

- Operational Complexity: Managing financing across their vast debtor network required extensive reconciliation and individual debtor onboarding processes

- Limited Debtor Coverage: Traditional financing options couldn’t provide comprehensive coverage across their diverse buyer spectrum without individual credit assessments

- Balance Sheet Constraints: Need for unsecured, off-balance-sheet funding to support their asset-light business model

- Scalability Requirements: Demand for solutions that could grow seamlessly with their expanding business

Traditional financing options, including NBFC loans and standard supply chain solutions, proved inadequate for addressing these fundamental operational and coverage challenges.

Trade Receivable Solution is the answer

Partnering with Vayana, FarMart implemented an innovative TRS structure that directly addressed the below core challenges:

- Eliminated Operational Burden: Single, scalable structure covering FarMart’s debtor portfolio with minimal reconciliation and no debtor onboarding requirements or involvement

- Comprehensive Debtor Coverage: Financing extended across their broad spectrum of buyers without individual credit assessments or contractual arrangements

- Unsecured, No-Recourse Structure: Clean financing with no recourse to FarMart, enabling off-balance sheet treatment

- Flexible Implementation: Replenishment model with quick implementation for faster liquidity access and pre-vetted legal documents by Vayana

- Capital Markets Gateway: Direct access to private capital markets with enhanced funding diversification

Transformative Results

TRS implementation delivered breakthrough results that validated its effectiveness in solving persistent financing challenges:

- Operational Efficiency: Eliminated debtor onboarding requirements and minimized complex reconciliation processes, streamlining working capital management

- Universal Coverage: Achieved financing across FarMart’s entire buyer spectrum without individual assessments or contractual complexities

- Scalable Growth Funding: Enabled business growth through flexible, replenishment-based funding structure

- Market Leadership: Established a pioneering deal in India’s corporate market, demonstrating TRS viability for similar businesses

- Strategic Foundation: Created a stable, long-term funding platform for larger future financing requirements

This success story illustrates how TRS can serve as more than just a financing tool—it becomes a strategic enabler of business growth and market expansion.

Key Considerations for Implementing TRS

- Portfolio Quality Assessment:

Successful TRS implementation begins with thorough analysis of the receivables portfolio, focusing on debtor concentration, creditworthiness, and historical collection performance. Companies must also evaluate industry diversification within their customer base and assess payment terms to ensure predictable cash flow.

- Structural Design:

The TRS structure must be carefully tailored to align with specific business needs and regulatory requirements. Key decisions include choosing between true sale versus secured lending treatment, selecting appropriate revolving or amortizing structures, and implementing necessary credit enhancement mechanisms.

- Stakeholder Management:

TRS involves complex coordination among multiple parties including the originating company, SPV trustees, investors, rating agencies, and legal advisors. Effective communication and relationship management across all stakeholders is essential for successful deal execution and ongoing performance.

- Regulatory Compliance:

TRS structures must navigate comprehensive regulatory frameworks encompassing securities regulations, accounting standards, and tax implications. Companies need to ensure full compliance with disclosure requirements while maintaining operational flexibility within the chosen structure

In conclusion, Trade Receivables Securitization (TRS)is more than a financing tool, it’s a strategic initiative for working capital optimization. Successful cases like the FarMart–Vayana partnership show how TRS can transform liquidity management and support growth.

When structured and managed well, TRS delivers stronger cash flow, financial flexibility, and access to diversified funding. With advancing technology, evolving regulations, and rising investor interest, TRS is set to become a key pillar of corporate finance. For companies considering TRS as part of their working capital optimization strategy, with proper structuring, expert guidance, and strategic implementation, Trade Receivables Securitization can serve as a powerful catalyst for sustainable business growth and enhanced financial performance.