Supply Chain Risk Assessment

Why Outsourcing Trade Debt Collection is a Smart Move for Indian Businesses

“Tea Traders struggle as dues worth crores remain unpaid by local factory owners”

“8 fabric traders booked for unpaid dues of 64.7 lakh”

“Cable TV faces broadcaster backlash over Rs 500 crore unpaid dues”

These are some headlines from the past few months that clearly show that the problem of unpaid dues is not only widespread but is also a big one. Maintaining a healthy cashflow is crucial for the success of any company but collecting outstanding debts from clients, suppliers, and distributors poses a huge challenge to it. Trade debt collection is a sensitive task requiring a great deal of tact, expertise, and patience. Given the complexity of the business landscape, companies are increasingly opting to outsource their trade debt collection to professional agencies as a practical and strategic solution to stay competitive. Here’s why:

1. Focus on Core Business Operations

For businesses that often operate with thin margins and face high competition, maintaining a focus on core operations is critical for growth. Debt collection, though important, can become a time-consuming and resource-draining activity, which is why outsourcing makes sense:

- Time-Consuming Process:

Chasing debtors requires constant follow-up and monitoring. It can divert the focus of your finance and operations teams, who would otherwise be working on more productive activities such as revenue generation or customer service. - Lack of Specialized Knowledge:

Debt recovery is a highly specialized process that requires a deep understanding of financial law, negotiation tactics, and sometimes cross-border legal expertise. Outsourcing to experts ensures that you have seasoned professionals recovering your dues while your team can continue focusing on what they do best.

2. Cost Efficiency

Outsourcing debt collection can reduce operational costs. Managing an in-house debt collection team involves:

- Hiring and training staff to specialize in this function

- The costs of maintaining the software systems required for monitoring debt

- Administrative expenses such as communication, travel, and other resources dedicated to follow-ups

Outsourcing eliminates all these costs. Moreover, typically, outsourced agencies charge a fee only when debts are successfully recovered, making it a win-win scenario for businesses.

3. Higher Success Rates

Professional agencies come equipped with several tools and skills that improve the likelihood of a successful recovery:

- Experience in Negotiation:

They specialize in negotiation techniques, understanding the debtor’s psychology and how to encourage them to clear the debt without damaging the client relationship. - Better Credibility:

When a third-party agency approaches a debtor, it often signals to the client that the matter is serious. This increases the chances of faster payments since the debtor wants to avoid legal consequences or a tarnished reputation. - Access to Resources:

These agencies often have access to advanced technology and databases that allow them to assess the financial health of debtors, track payments, and identify trends that help in quick recovery.

4. Legal Expertise and Compliance

India’s legal landscape for debt recovery is quite complex. The Negotiable Instruments Act, 1881, Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, the Recovery of Debts Due to Banks and Financial Institutions (RDDBFI) Act, 1993, and the Insolvency and Bankruptcy Code (IBC), 2016 make the process of trade debt collection both legally challenging and time-consuming. Without proper knowledge of the legal process, businesses might risk lengthy litigations or legal loopholes that can delay recovery or result in uncollected dues.

Professional debt collection agencies are well-versed in Indian legal frameworks and can navigate these complexities with ease. They ensure that:

- All recovery activities are compliant with the law.

- Necessary steps are taken in case of disputes or court proceedings.

- The debtor’s rights are respected while protecting the interests of the client, thus minimizing any legal exposure.

This legal expertise gives businesses peace of mind and shields them from legal entanglements while improving their chances of recovering bad debts.

5. Preserving Client Relationships and Reputation

One of the main concerns for businesses when collecting trade debts is the fear of damaging important client relationships. In a market that values personal relationships and long-term partnerships, it is important to approach debt collection with sensitivity.

- Avoid Personal Confrontations:

Business owners or finance teams may find it difficult to adopt a firm stance without damaging the rapport they have built with clients. A third-party agency can function as a buffer, allowing businesses to maintain their professional relationships while still recovering their dues. - Tailored Communication:

Collection agencies often customize their approach based on the nature of the debtor—be it a small business, corporate client, or individual. This ensures a nuanced approach to each debtor, improving the likelihood of recovery while minimizing friction.

Collection agencies take a more discreet approach to recovering debts, ensuring that the process is managed professionally and sensitively without causing undue harm to your company’s standing in the business community. Thus, by outsourcing the debt collection process, you can avoid the negative image of being seen as overly aggressive in pursuing outstanding payments.

6. Scalability and Flexibility

Businesses, especially SMEs, often experience fluctuations in their cash flows. During periods of high demand, when companies extend more credit to customers, outstanding debts can pile up. Outsourcing debt collection provides flexibility and scalability, as businesses can rely on external agencies to manage spikes in debt recovery needs without expanding internal teams.

- Seasonal Scaling:

For businesses with seasonal sales peaks (such as retail or agriculture), outsourcing debt collection allows for scaling the recovery efforts without needing to onboard additional staff. - Tailored Packages:

Most debt collection agencies offer flexible packages and pricing models, allowing businesses to choose services that align with their specific financial needs and challenges.

7. Mitigating Risk

Delayed payments or non-payment is a major concern, particularly for SMEs that operate with limited liquidity. When accounts receivables are not managed effectively, they can affect the overall health of the business and lead to significant losses.

Debt recovery agencies not only help recover debts but also provide consultation on credit risk management, helping businesses to:

- Identify potential risk early,

- Improve credit policies and customer assessment procedures,

- And maintain healthier accounts receivable.

This proactive approach can protect businesses from long-term financial strain and allow them to maintain a strong balance sheet.

Outsourcing Debt Collection: A Strategic Solution

Outsourcing trade debt collection is not just a solution to a pressing problem—it is a strategic move for Indian businesses looking to streamline operations, reduce costs, and maintain a healthy cash flow. Studies have shown that businesses using professional debt collection agencies can recover up to 30% more of their outstanding debts. With the legal complexities and challenges unique to India’s business environment, partnering with a professional debt collection agency allows businesses to focus on growth while ensuring that outstanding dues are recovered efficiently and diplomatically.

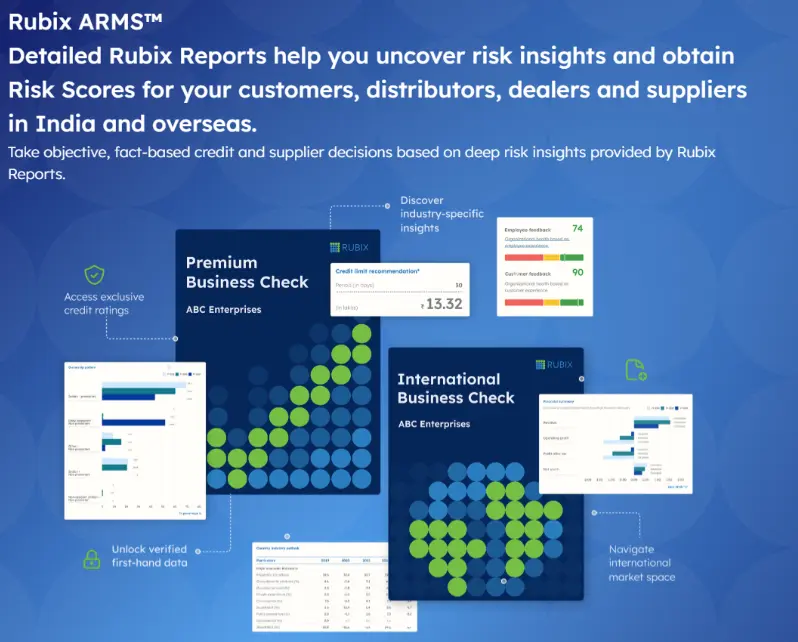

Rubix Data Sciences offers a comprehensive B2B debt collection solution, leveraging collection analytics, proactive communication, and a large field network to recover debts efficiently. Its technology-optimized and legally-backed approach ensures a smooth and professional recovery process while helping businesses maintain positive client relationships.

Read Also – Risk Management through Rubix’s data and risk analytics