Supply Chain Finance Solutions to optimize Working Capital and improve Cashflow.

Supply Chain Finance Solutions to optimize Working Capital and improve Cashflow.

$0Bn+

Financing facilitated

0K+

MSMEs engaged

0+

Supply chains covered

0+

Corporates covered

0+

Cities in India

For Corporates

Discover our Payables and Receivables programs

Single platform for all SCF Programs

Predictable cashflows

20+ major Financial Institutions

Maximum reach and program adoption

For FIs (Financial Institutions)

Discover our comprehensive SCF suite

Cloud-based digital infrastructure

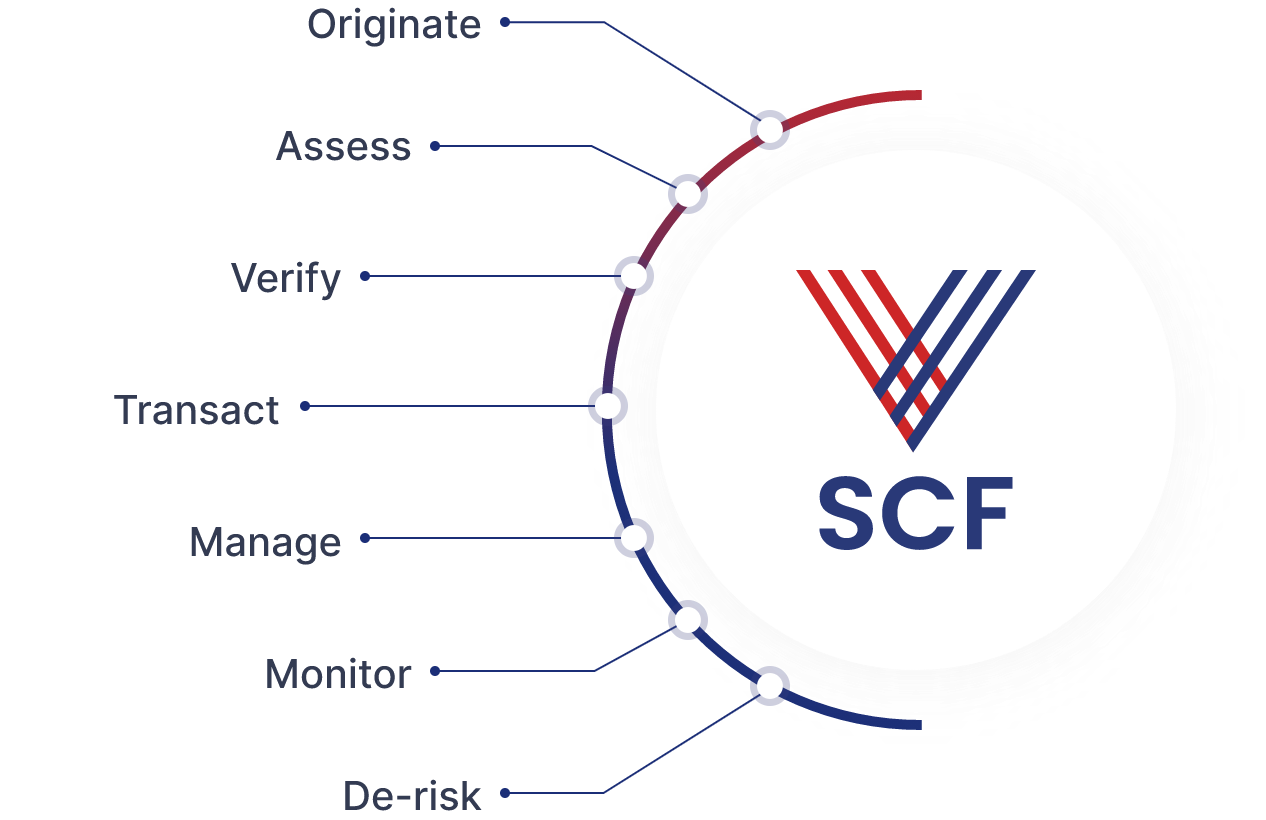

From Loan Origination to Risk Management

Corporate Origination and Network Services

Efficient integration with Corporates

Vayana offers upstream and downstream, anchor-led financing programs for your supply chain.

Payable Financing

A suite of financing programs that enable anchors to make early payments to vendors without impacting their own cash flows, improving supplier liquidity and strengthening relationships.

Vendor Financing

Vendors receive early payments against approved invoices, funded by Financial Institutions, without burdening Anchor Corporate’s balance sheet.

How it Works

Credit limits are established for each supplier.

The anchor reviews and approves supplier invoices.

Vayana facilitates funding through partnered banks and NBFCs.

Suppliers receive early payments at competitive financing rates.

The anchor (buyer) repays the Financial Institution on the invoice due date.

Key Benefits

Strengthens supplier relationships

Zero impact on buyer’s balance sheet

Improves vendor liquidity

Purchase Bill Discounting (PBD) / Payable Financing

Enables anchors to extend their Days Payable Outstanding (DPO) by financing vendor invoices directly, without vendor involvement.

How it Works

Bank/NBFC sets limits based on the anchor’s credit.

Vendor invoices are financed without vendor intervention.

Anchor draws on the credit line to pay early.

Repayment is made as per extended terms.

Key Benefits

Increases DPO

No vendor onboarding required

Reduces procurement bottlenecks

Reverse Factoring

A buyer-initiated program that enables suppliers to receive early payments at lower cost, leveraging the buyer’s credit profile.

How it Works

Buyer approves supplier invoices.

Supplier selects invoices for early payment.

FIs disburses funds to the supplier.

Buyer repays the financier on the due date.

Key Benefits

Immediate liquidity for supplier

Lower interest rates due to buyer risk

Strengthens supply chain reliability

Receivables Financing

Programs that help corporations receive early payments on sales by financing receivables, thus accelerating collections and improving cash flows.

Dealer Financing

An approved credit facility enables dealers to increase purchases, with anchors receiving upfront payments and dealers settling dues at a later date.

How it Works

Credit line is established for dealers

Dealers utilize it to purchase goods from the anchor

Anchor receives upfront payment from the Financial Institution

Dealer repays the Financial Institution as per agreed terms

Key Benefits

Boosts sales and market penetration

Reduces Days Sales Outstanding (DSO)

Improves dealer loyalty and performance

Receivables Financing

Corporates get early payment on sales invoices without taking on debt, using a flexible and selective invoice discounting model.

How it Works

Credit limits are set by the Financial Institution based on the anchor’s profile

Anchor selects approved invoices to be financed under the assigned limit

FI disburses early payment after deducting a discount or fee

Anchor repays the FI on the invoice due date

Key Benefits

No collateral or debt on books

Improves cash flow predictability

Flexible invoice selection

Factoring

Corporates sell their receivables to a financial institution (Factor) to access upfront cash and shift the collection burden – either with or without recourse.

How it Works

Anchor assigns receivables to the Factor

Factor disburses a percentage of the invoice value upfront

Upon collection, the balance is paid to the anchor after deducting fees

Key Benefits

Reduces credit risk

Improves liquidity

Cuts down internal collection efforts

Cross Border Financing

Programs that help corporations receive early payments on sales by financing receivables, thus accelerating collections and improving cash flows.

Cross-Border Financing

Post-Shipment financing for exporters to realize up to 90% of invoice value upfront

How it Works

Exporter ships goods and generates an invoice

Vayana arranges funding from global financial partners

Exporter receives 80–90% of invoice value upfront

Key Benefits

No need for collateral or bank credit line

Supports longer payment terms

Global reach with local onboarding

A suite of financing programs that enable anchors to make early payments to vendors without impacting their own cash flows, improving supplier liquidity and strengthening relationships.

Vendor Financing

Vendors receive early payments against approved invoices, funded by Financial Institutions, without burdening Anchor Corporate’s balance sheet.

How it Works

Credit limits are established for each supplier.

The anchor reviews and approves supplier invoices.

Vayana facilitates funding through partnered banks and NBFCs.

Suppliers receive early payments at competitive financing rates.

The anchor (buyer) repays the Financial Institution on the invoice due date.

Key Benefits

Strengthens supplier relationships

Zero impact on buyer’s balance sheet

Improves vendor liquidity

Payable Financing

Enables anchors to extend their Days Payable Outstanding (DPO) by financing vendor invoices directly, without vendor involvement.

How it Works

Bank/NBFC sets limits based on the anchor’s credit.

Vendor invoices are financed without vendor intervention.

Anchor draws on the credit line to pay early.

Repayment is made as per extended terms.

Key Benefits

Increases DPO

No vendor onboarding required

Reduces procurement bottlenecks

Reverse Factoring

A buyer-initiated program that enables suppliers to receive early payments at lower cost, leveraging the buyer’s credit profile.

How it Works

Buyer approves supplier invoices.

Supplier selects invoices for early payment.

FIs disburses funds to the supplier.

Buyer repays the financier on the due date.

Key Benefits

Immediate liquidity for supplier

Lower interest rates due to buyer risk

Strengthens supply chain reliability

Programs that help corporations receive early payments on sales by financing receivables, thus accelerating collections and improving cash flows.

Dealer Financing

An approved credit facility enables dealers to increase purchases, with anchors receiving upfront payments and dealers settling dues at a later date.

How it Works

Credit line is established for dealers

Dealers utilize it to purchase goods from the anchor

Anchor receives upfront payment from the Financial Institution

Dealer repays the Financial Institution as per agreed terms

Key Benefits

Boosts sales and market penetration

Reduces Days Sales Outstanding (DSO)

Improves dealer loyalty and performance

Receivables Financing

Corporates get early payment on sales invoices without taking on debt, using a flexible and selective invoice discounting model.

How it Works

Credit limits are set by the Financial Institution based on the anchor’s profile

Anchor selects approved invoices to be financed under the assigned limit

FI disburses early payment after deducting a discount or fee

Anchor repays the FI on the invoice due date

Key Benefits

No collateral or debt on books

Improves cash flow predictability

Flexible invoice selection

Factoring

Corporates sell their receivables to a financial institution (Factor) to access upfront cash and shift the collection burden – either with or without recourse.

How it Works

Anchor assigns receivables to the Factor

Factor disburses a percentage of the invoice value upfront

Upon collection, the balance is paid to the anchor after deducting fees

Key Benefits

Reduces credit risk

Improves liquidity

Cuts down internal collection efforts

Programs that help corporations receive early payments on sales by financing receivables, thus accelerating collections and improving cash flows.

Cross-Border Financing

Post-Shipment financing for exporters to realize up to 90% of invoice value upfront

How it Works

Exporter ships goods and generates an invoice

Vayana arranges funding from global financial partners

Exporter receives 80–90% of invoice value upfront

Key Benefits

No need for collateral or bank credit line

Supports longer payment terms

Global reach with local onboarding

Loan Origination System

Streamlined Applications & Flexible Credit Assessment

Swift approvals and loan processing

Instant updates on application status

Secure document and data access

Scalable and growth-ready platform

Transaction Platform

Efficient Financing with Simplified Connectivity

Unified SCF platform

Rapid fund disbursement facilitation for FIs

Standardized data & automated validations

Real-time tracking and audit trail

Limit Management System

Cloud-based Limit Management for Lower Capex

Invoice-level loan tracking

Automates interest calculations

Monitors credit limits in real-time

Provides actionable insights and analytics

How Does Supply Chain Finance Work?

Vayana ensures real-time reconciliation and visibility for all parties across the lifecycle.

Vayana acts as the technology and infrastructure backbone, enabling corporates, their suppliers, and dealers to seamlessly collaborate with financial institutions to optimize working capital, reduce risk, and build stronger, scalable supply chains.

Transaction Initiation (Supplier or Dealer)

Whether it’s a supplier dispatching goods or a dealer placing a purchase order, the transaction starts with a flow of goods and documents (invoice, PO, etc.).

Vayana integrates with the corporate’s ERP to digitize and capture data in real time, whether receivables or payables.

Buyer Approval

Financing Options Rolled Out

Disbursement of Funds

Buyer Makes Final Payment

Vayana ensures real-time reconciliation and visibility for all parties across the lifecycle.

Vayana acts as the technology and infrastructure backbone, enabling corporates, their suppliers, and dealers to seamlessly collaborate with financial institutions to optimize working capital, reduce risk, and build stronger, scalable supply chains.

How can Supply Chain Finance Benefit Corporates or Enterprises?

Supply Chain Finance (SCF) strengthens your cash flow, empowers supplier and dealer relationships, and drives operational efficiency across your value chain.

Benefits for Buyers

Unlock working capital by extending payment terms without straining supplier relationships

Gain better visibility and control over payables

Strengthen supplier reliability and continuity

Improve balance sheet health and liquidity ratios

Reduce supply chain disruption and risk exposure

Benefits for Suppliers

Access early payments on approved invoices without waiting for due dates

Lower financing costs compared to traditional loans

Improve cash flow predictability and working capital efficiency

Build long-term trust and credibility with buyers

Reduce dependence on external credit lines

What partners and clients say

What partners and clients say

Frequently Asked Questions

Supply Chain Finance (SCF) refers to a set of technology-led financing solutions that optimize working capital across the entire supply chain, both upstream (receivables) and downstream (payables). It enables buyers to extend payment terms while giving suppliers access to early payments. On the other side, suppliers can offer early payment terms to their buyers and get financed against their receivables. SCF enhances liquidity, strengthens supplier-buyer relationships, and builds resilient supply chains.

The primary parties in Supply Chain Finance (SCF) include the buyer, supplier, and the financial institution providing the financing. Additionally, fintech enablers like Vayana play a crucial role by providing the technology and infrastructure that connect all parties, streamline processes, and scale the SCF program efficiently.

Vayana plays a pivotal role as the technology enabler and program orchestrator in Supply Chain Finance (SCF).

For FIs, Vayana provide the infrastructure to launch, manage, and scale SCF programs easily, including onboarding, compliance, and end-to-end visibility.

For Corporates and SMEs, we offer a single platform to access a wide range of SCF programs across the entire supply chain, along with automation for invoice uploads, approvals, reconciliation, and real-time tracking.

Suppliers benefit from SCF by gaining quicker access to working capital, reducing the need for expensive short-term financing, and mitigating payment risk. They can also negotiate better terms with buyers.

Buyers can benefit from SCF by optimizing their working capital, improving relationships with suppliers, and potentially negotiating discounts for early payments. It also enhances the overall stability of the supply chain.

SCF is used by businesses of all sizes. Large corporates often implement SCF programs to enhance their supply chains, but the programs can be tailored to meet the needs of smaller enterprises as well.

SCF shares similarities with factoring and invoice discounting, but it’s a broader concept that focuses on optimising the entire supply chain’s financial health. Factoring and invoice discounting primarily involve selling receivables to a third party.

Yes, SCF programs are often tailored to meet the specific requirements of a supply chain. The financing terms and conditions can be adjusted to accommodate the unique dynamics of each supply chain.

To implement SCF, you can start by identifying a partner who understands both your business goals and your supply chain dynamics. Financial institutions and enablers like Vayana can help you set up the right SCF program, be it for payables, receivables, or both.

At Vayana, we make it simple to launch and scale SCF across your ecosystem with program design tailored to your supply chain structure and working capital needs, easy onboarding for corporates and counterparties, and access to a wide network of FIs.

Yes, SMEs benefit significantly from SCF — it ensures they get paid on time, improves liquidity for day-to-day operations, and helps build stronger, more reliable relationships with the large corporates they work with.

Key performance indicators (KPIs) for SCF success include improved days payable outstanding (DPO), days sales outstanding (DSO), and supplier satisfaction. An effective SCF program can also be assessed by its impact on working capital.