CFO Mindset and Strategies

How eco-conscious consumers are transforming F&B supply chains: The impact on your dealers and vendors

Consumer food preferences have changed dramatically in the last decade. Words like gluten-free, vegan, lactose-free, mock meat, plant-based food have moved from being seen on just product on packaging to finding a seat at meal tables. Spurt of celebrity interest in plant-based meat and milk is impressing health-conscious millennials and gen-z to make sustainable shifts in daily consumption. The new food categories created, are leading to supply chains’ transformation across the globe and large organizations are now finding ways to innovate their production and operations to meet evolving consumer expectations. This article explores how changing consumer food preferences are driving transformation in F&B supply chains and highlights the pivotal roles of dealers and vendors in adapting to these evolving trends.

In March 2022, data released today by the Plant Based Foods Association (PBFA), The Good Food Institute (GFI), and SPINS, shows U.S. retail sales of plant-based foods grew 6.2% in 2021 over a record year of growth in 2020, bringing the total plant-based market value to an all-time high of $7.4 billion.

In India too, the vegan food market is expected to exhibit a CAGR of 11.32% during 2022-2027, as consumers are becoming increasingly health-conscious and aware of the benefits, compared to animal-based food products. Most of the local cafes and large QSR & coffee chains, are introducing vegan and plant-based food options in their menus, because of which farm to fork stories are seeing a paradigm shift, bringing new meaning to sustainable consumption. So, what does this mean for F&B supply chains, where the big brands are geared with financial backing yet, the dealers and vendors need to reengineer trade and operations?

1.Look beyond the dollar

Large organizations may have financial capacities and operational excellence to catch up growing trends and enter the new food F&B categories. But they will need to look beyond these two fundamentals and invest heavily in consumer listening especially when the buyers are Gen – Z and Millennials, the two generations who are trendsetters in their own way, very aware and eager to know the source of it all. This means, material sourcing may need to happen through new vendors, new selection parameters may need to be implemented with reference to facility or skilled staff, advanced food processing machines (no touch / hygienic) will need to be procured, right channel partners will need to be identified and engaged to shelf such products in the right geographies.

2.Educate and empower channel partners

In case of vendors, small businesses within the supply chains lack technical know-how. They need to constantly adapt to emerging consumer needs. Likewise at the distributors’ end, there are enough and more local cafes and bakeries that are doing well, biting into the share of current brands, because they may have limited, yet authentic sourcing capabilities to enjoy a loyal customer base. The onus lies on large corporates to ensure their business partners (both vendors and dealers) are not only aware of the new trends but also equipped with right tools drive volumes and create differentiation within these alternate food and beverage categories.

3.Finance them right for sustainable growth

Emerging category of alternate food, has no large brands leading the way and customers are currently experimenting with food choices, displaying zero loyalty. In such cases, corporates attempting to venture into new F&B categories, may be tempted to opt for D2C approach to reach the experimenters. But, existing established brands will rely on traditional supply chains and consider adding new SKUs.

It is important to note that adding new vendors may give rise to cashflow management issues for the corporates and dealing with new SKUs will require additional capital or extended credit period for dealers and distributors as, it will take time for the new experimenting consumers to try, adopt and add alternate food to their regular shopping carts.

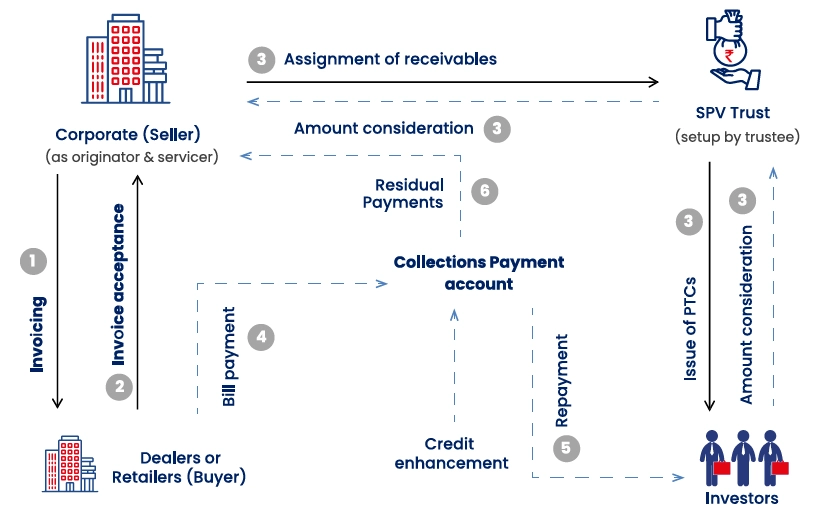

With Vayana’s vendor financing and dealer financing programs, the channel partners are offered direct limits based on their ongoing trade relationship with anchors. As a result, these vendors, and dealers can access capital at a much lower interest rate in their time of need. In case of higher margin products like the new food categories of plant-based meat, mock meat or gluten-free products, the interest can be paid either by corporate or the supply chain participant or shared by both and will make it easy to launch these food products for the rising segment of new consumers.

Also, through advanced analytics, Vayana monitors the business health of these channel partners (both Vendors and Dealers), which help corporates discover the right partners and provide early indicators of the market performance.