The lifeblood of any small business is working capital—the cash needed to keep the doors open and operations running smoothly.It is estimated that over 70% of a Small- or Medium-sized Enterprise’s (SMEs) financial needs fall under this category. However, banks and financial institutions often offer a limited range of traditional short-term loan products that may not perfectly align with the specific needs of these businesses. This disconnect creates a cash flow challenge for these businesses, hindering their growth potential. In this scenario, Supply Chain Finance (SCF) is a viable financial tool that offers a more flexible and efficient way for businesses to manage their working capital and thrive.

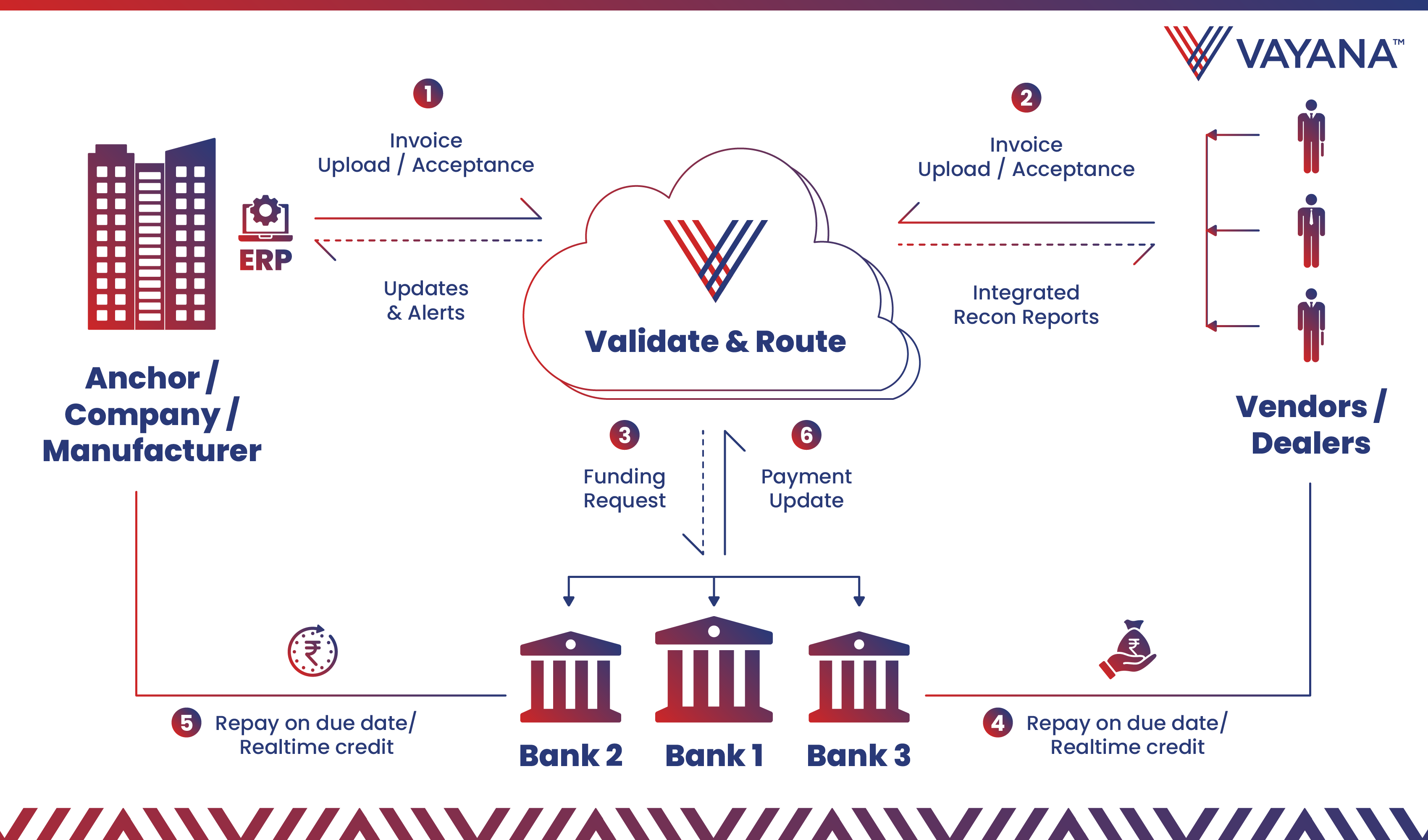

Here’s an example of how it works:

- A supplier sets up an SCF program with a bank or financial institution on a trade credit platform.

- A buyer purchases goods or services from the company on credit, agreeing to pay the consideration after a certain period (usually 45-60 days).

- The supplier fulfils the order and uploads the delivery proof and invoice on the trade credit platform.

- The buyer confirms acceptance of the invoice on the platform.

- The bank or financial institution pays the amount due (minus interest or fees) to the supplier immediately.

- On the original due date of the invoice, the buyer pays the amount due to the bank or financial institution directly, instead of paying the supplier.

Whether you are a buyer or seller, SCF offers a win-win situation by optimising cash flow, strengthening relationships, and unlocking growth opportunities. For instance, Vayana collaborated with a Tier-I Retail & Fashion Company in India to provide dealer and distributor finance. By implementing automated financing workflows on its platform, Vayana streamlined the trade credit process and optimised the Corporate’s working capital, fostering strengthened relationships with distributors/ dealers, and significantly improved payment cycles. A transaction that once took weeks now takes only a few minutes, with the Corporate receiving its money within minutes of its invoices being uploaded on the platform and accepted by buyers. Vayana’s program for this Retail & Fashion Company successfully engaged over 600 distributors and dealers, achieving an impressive 78% utilisation rate. Furthermore, Vayana’s collaboration with multiple banks diversified the program’s reach, catering to the unique needs of various distributors and dealers across the country.

It is important to note that the specific needs of companies within a supply chain can vary depending on their tier.

Large, established companies, categorized as Tier 1, typically focus on optimizing their working capital. They may use Supply Chain Finance (SCF) to receive cash against invoices at a discount immediately. Additionally, these companies often set up distributor or dealer finance programs to help their dealers purchase more products. They also develop supplier finance programs to secure better terms from their suppliers.

In contrast, SMEs in Tier 2 and Tier 3 towns often have limited access to traditional financing. For these businesses, supplier financing and invoice discounting programs can address their need for working capital. Factoring can also help them grow by increasing their export activities.

Factoring can also help them grow by increasing their export activities.

SMEs that supply raw materials, such as agricultural produce, are frequently located in rural areas beyond Tier 3 towns. For these companies, supply chain finance programs set up on platforms with large buyers can provide access to timely trade finance. Such programs are crucial in supporting their growth by ensuring they receive the necessary funds when needed.

Now, let’s look at how SCF fuels business growth for both buyers and sellers:

Buyer’s Perspective:

- Augmenting Working Capital: A core benefit of SCF is the ability to augment the working capital of buyers. In SCF programs, sellers get paid immediately by banks/ financial institutions while buyers can enjoy longer credit periods. This frees up significant working capital for buyers, which they can tactically allocate towards growth initiatives like marketing campaigns, expanding sales reach, etc.

- Stronger Supplier Relationships: By offering early payment options through SCF, buyers can develop stronger, more collaborative relationships with their suppliers. This goodwill can lead to several advantages: suppliers become more invested in the buyer’s success, potentially offering more competitive pricing, prioritising deliveries, and ensuring higher quality goods.

- Supply Chain Risk Mitigation: If a supplier has financial difficulties, it could end up delaying production, which, in turn, can result in supply chain problems for buyers. SCF can mitigate the risk of disruptions or delays within the supply chain. Supply Chain Finance platforms often deploy risk management tools to help assess and monitor the financial risk of entities. Rubix Data Sciences’ risk-assessment tools, for example, provide continuous monitoring of key compliance and financial indicators to identify potential supplier problems before they disrupt your supply chain. This is an additional benefit of using SCF platforms that helps buyers ensure that they are working with financially healthy suppliers.

Seller’s Perspective:

- Improved Cash Flow and Early Payments: For many suppliers, especially SMEs, waiting for standard payment terms strains their cash flow. Thankfully, SCF provides immediate access to cash to suppliers upon invoice acceptance by buyers; this allows sellers to meet their financial commitments, like payroll or payments to their own suppliers, on time. This cash flow stability fosters a more confident and operationally smooth business environment for the seller.

- Reduced Financing Costs: Traditionally, suppliers rely on external financing options such as working capital loans to bridge cash flow gaps. These could be from banks, non-banking financial companies (NBFCs) or other lenders. Unless suppliers have very high credit ratings, these external financing options for working capital generally come with higher interest rates and commitment fees, both of which add to the financing cost. On the other hand, SCF programs are always transaction based, meaning that financing costs are levied only for the period of the sale/purchase transaction. No commitment fees are levied on SCF transactions. This translates into substantial cost savings for the supplier.

- Enhanced Business Opportunities: Improved cash flow through SCF allows suppliers to take on larger orders with greater confidence. They can also invest in expanding their operations, sales, and marketing efforts, or improving their product quality which translates into increased business opportunities and overall growth.

The Future of SCF: Embracing Technological Innovation

Supply Chain Finance (SCF) is rapidly evolving beyond traditional models. The rise of blockchain technology, for instance, holds immense promise for streamlining processes and enhancing transparency across the supply chain. By creating a secure and tamper-proof record of transactions, blockchain can automate invoice verification, reduce fraud risks, and expedite settlements. Additionally, Open Banking initiatives are promoting collaboration between financial institutions and SCF platforms, enabling seamless data exchange and faster onboarding of new participants. Furthermore, the future of trade finance includes the widespread adoption of MLETR (Model Law on Electronic Transferable Records). This facilitates the use of electronic records in place of paper-based documents, aligning seamlessly with blockchain technology to enhance security and efficiency. Vayana’s ETP division is actively exploring trade financing solutions using digitized trade documents that utilize the MLETR framework. As these technological advancements continue to integrate with SCF, we can expect even greater efficiency, automation, and risk mitigation within supply chains.

In a fast-growing country like India, the role of Supply Chain Finance platforms in making timely and affordable credit available to the smallest entity in supply chain, is instrumental for financial inclusion as well as overall smooth functioning of enterprises.