CFO Mindset and Strategies

Beyond KPIs: how a CFO can judge ROI on marketing for business growth.

Conducting a cost & benefit analysis on marketing can be greatly frustrating. As when return and spend cannot be neatly displayed for judgement, it disrupts a CFO’s entire way of functioning. Discomfort further rises when the question of, “Will investment will lead to more sales?”, is answered by a sincere, “It depends”. Well, while the CFO’s frustration is valid, there is nothing deliberate behind the ambiguous nature of marketing performance. It is just the way it is. No form of excel or financial modelling can force marketing results to comply into a predictable pattern. Hence, it requires a CFO to understand the reason behind the noise, to finally decode performance and ensure business growth.

1 . Customers need to be prepared for a sale

The role of marketing in closing a sale, arises much before that concluding moment. While this end action is what commonly defines success, there is an entire journey that occurs before the customer even considers purchase. Customers that passionately want your product aren’t a feat of accident, as some enter the pipeline more interested in competitors, and others aren’t even aware of their need. Hence, with each customer starting from a different point, it becomes the work of marketing to patiently inch customers closer to purchase. Any work that converts their desires closer towards this finish line, even if not resulting in immediate sales, is productive.

Such a perspective welcomes awareness as a key objective. Thus, a starting method to measure performance can be asking your target audience if they have heard of your business. At first, they might reply with a simple, “Yes”. But after a while a few might associate you with a particular industry, and later even know about your product offerings. Thus, signalling progress towards the purchase decision and perhaps business growth.

2 . B2B customers are not as ‘rational’ as we think they are

Now, while a CFO might be convinced to look beyond sales, they might still be hesitant to spend on top-of-the-funnel marketing. As logically speaking, a customer will purchase when faced with a requirement. Why then, should the business invest in being well known? Well, this is because the B2B space is not as ‘rational’ as it seems. The slogan “Nobody ever got fired for buying IBM” is famous for this reason. It got CIOs around the world to quickly choose a ‘safe’ and ‘trustworthy’ product where, the prominence of the brand directly influenced purchase. Hence, successful marketing fast-tracks the decision-making process. Where instead of rationally weighing each option, the customer heuristically choses a familiar brand.

Thus, a relevant measure captures this bias towards the brand, against competition. As the business rises the ranks, progress in brand preference can be inferred.

3 . Brand reorganizes market demand

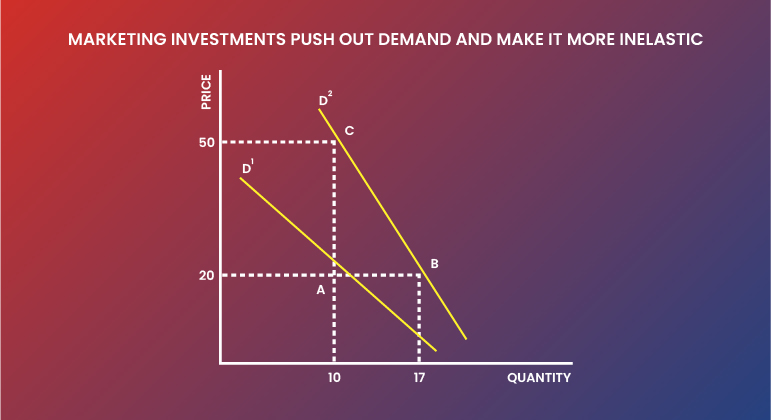

Going back to the IBM example, workers weren’t exempt from being fired because IBM was the right choice each time, but because it was the standard choice. Having an established brand supposes more intrinsic value than reality. This results in two benefits. First, a disproportionate, although delayed, rate of return. Lead generation usually requires targeted effort, but as brand prominence builds with greater investment, more leads begin to roll in passively. Thus, drastically bringing down short-term costs and shortening the conventionally long B2B sales cycle. Second, as per textbook economics, a change in taste shifts the demand curve. With marketing investment improving customer preferences vis-à-vis the business, the same quantity can be sold at a higher price. And the brand even enjoys the benefits of a monopoly, such as being able to charge a premium. Hence, the volume of passive leads and the premium charged can be used as additional measures for measuring marketing performance.

Going through this, it becomes easier to understand the CFO’s frustration, as none of the above measures display a predictable pattern in business growth. With marketing performance contracting and expanding over time, any pattern is only understood in retrospect. Hence, while these measures do provide some numerical picture on performance, effective judgement occurs when the CFO meets in the middle, by understanding the animate nature of marketing.

At Vayana, we understand that navigating the intangible aspects of marketing ROI can be challenging for CFOs. That’s why we offer more than just financial solutions. we empower business leaders to make sense of complex performance metrics and align them with long-term growth strategies. If you’re ready to move beyond KPIs and truly decode how marketing drives enterprise value, explore how Vayana can support your finance and marketing alignment.