Supply Chain Finance

A Budget full of opportunities; from the lens of supply chain finance experts

A country is often measured by peoples’ character. Their willingness to work hard, their appetite to take risks or their strength to bounce back collectively. India’s character is lustrous for these very characteristics demonstrated by its growth engines – The MSMEs. Budget 2023 has given enough emphasis on the MSME sector, paving way for institutions to serve them better. The Saptrishis (pillars of growth) laid down by the finance minister is an ocean of opportunities for organizations to swim, discover and conquer. Let us look at each of these 7 fundamentals that will enable better growth for every entity in the supply chain (including the last mile), and thereby the economy.

1. Infrastructure and investment to fast-track trade

As an Indian citizen to travel to another state or town has become a matter of ease and pride. Thanks to the roadways and railway infrastructure we see around us. From hyper-active metro projects and large flyovers connecting cities to the well-equipped public transport for the burgeoning middle class, the government’s investment on infrastructure is aimed at making travel easy. This is evident from the capex outlay assigned to railways, heliports, airports, aerodromes and advanced landing zones. What this means is, a small spare parts business owner in Mumbai need not drive for five hours to reach his client’s automobile manufacturing plant in Chakan, Pune. Vista dome trains and projects like nava sheva sea link will deliver on the promise of speed and comfort, at a reasonable cost and this could perhaps translate in faster trade between cities thereby faster go to market to service the end customer. Additionally, new start-ups in logistics space can be hugely benefitted with the push on infrastructure in this budget

2. Financial sector to step up and improve MSMEs quality of life

Timely and affordable credit to all MSMEs up to the last mile should be a priority for financial institutions to enable free flow of trade between supply chains. To alleviate stress for MSMEs, an infusion of INR 90 billion in the corpus will allow collateral-free credit of INR 2 trillion. This will have a ripple effect on supply chains.

- More undeserved MSMEs will be able to come into the ecosystem, without any collatoral to fulfil theire working capital gap and avail affordable credit on time

- Banks will be able to reach the ignored sector all the way to the last mile, due to better credit-readiness

- Corporates will be able to give larger orders to the right channel partners, with better cashflow predictability

FinTechs like Vayana along with Banks and FIs will continue to make life easy for these small businesses and make them credit-ready.

3. Green growth for greater good

Go green as an individual or community act will hopefully percolate into something more collective, for the greater good. This pillar of budget will transform supply chains for good, where corporates and institutions will be encouraged to draft & review ESG policies that not just add to stakeholder value but translate into better employment opportunities, education of the workforce and a circular economy. Waste to wealth plants, Coastal shipping as an energy-efficient mode of transport, Battery Energy Storage Systems with 4000 watts capacity, Vehicle scrapping policy are all directed towards driving sustainable economic development. Farming,

construction, and mobility will see a huge uptick when it comes to getting access to funds and green credit programs will be utilised smartly by anchors to augment a pro-planet, pro-people way of life. FinTechs in India have a huge opportunity to design and offer sustainability linked loans to key sectors and test its adoption within the given framework. Outlay & focus on Zero Carbon Emission by 2070 will also trigger the building of Green FinTechs.

4. Inclusive development to encourage young rural entrepreneurs

When we speak of India’s agricultural sector, we often associate it with largest area that plants wheat, rice, and cotton, and largest producer of milk, pulses, and spices in the world. It is also the primary source of livelihood for about 58% of India’s population. But who knew Millets would become the showstopper of Budget 2023. With growing consumer awareness on mindful eating and adoption of vegan and gluten-free foods, it was impossible for the central government to ignore the importance of millets in daily consumption. There are enough and more start-ups manufacturing healthy bars, cookies, cakes even made from millets or Shree Anna as we call them. Enhanced credit support and accelerator funds will encourage young rural entrepreneurs to educate themselves, boost manufacturing and export such products at scale.

5. Youth power when skilled can make miracles

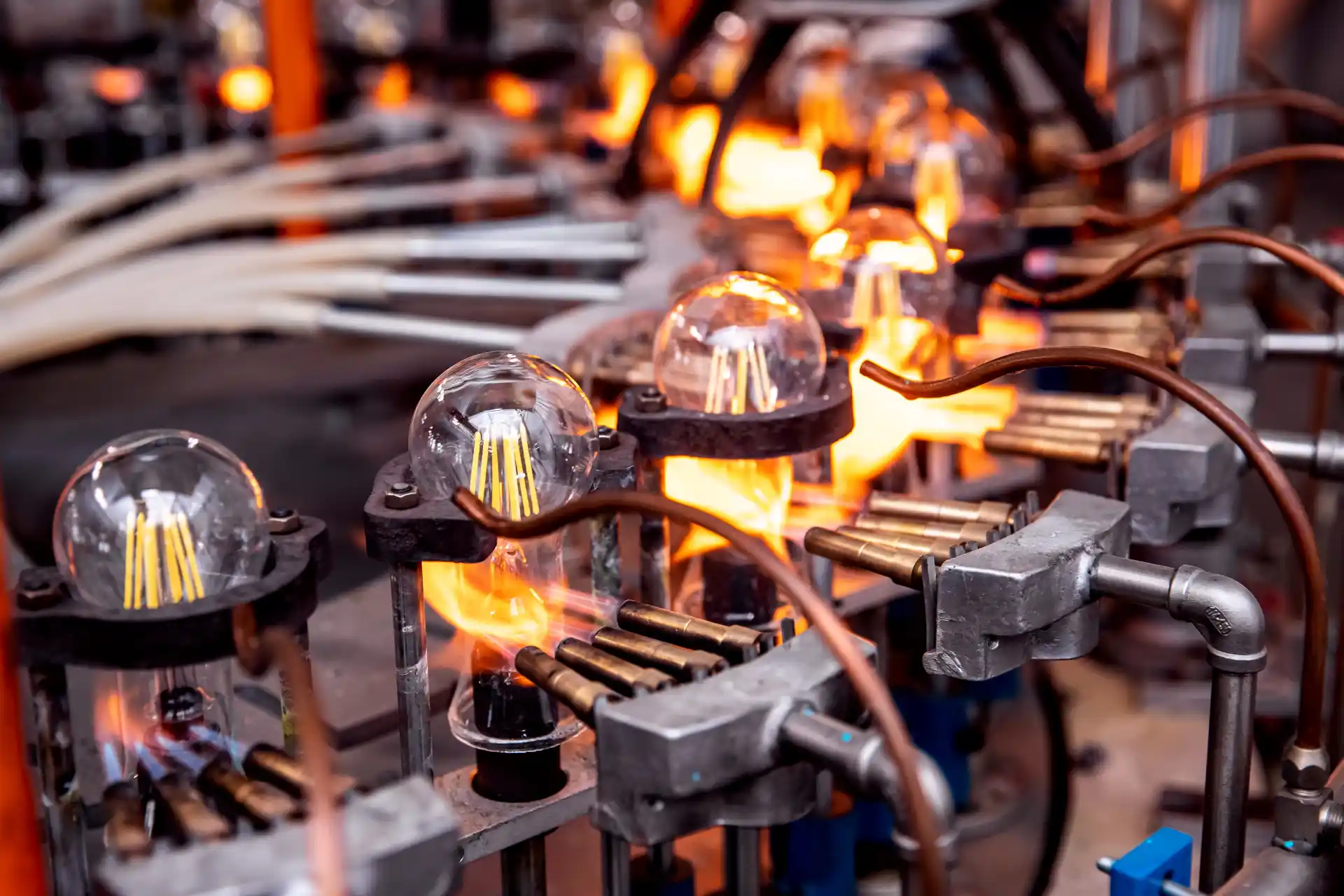

Having a skilled workforce, means having future-ready workforce. Today there is a huge skill gap in MSMEs as well as workers on the shop floor of large organizations. Skill India Digital Platform is designed for demand- based skilling, which some corporates have opted for. Hardware & electronic shops around the corner for example, primarily accepted cash payments for purchase of tubes or bulbs which is not an everyday essential item. During the pandemic, this segment took a hit, forcing shutdowns. These are typical small business owners who would have diverted their lines of business or upskilled themselves to look beyond buying & selling. One

such hardware shop owner, upskilled himself to fix lights and went on to become a plumber and electrician serving the neighbourhood. Another example is that of shopfloor workers in a large textile company, who initially only managed weaving, cutting & sewing. As times advanced, digital programs are being deployed by the L&D teams to enable workers to learn how one cotton crop is different from another, how does traceability work throughout the supply chain with blockchain technology and how these towels and bedsheets are shelved in stores thereby giving more information of the product to the end customer. Such schemes can make supply chains more efficient and smarter, which adds to the competitive advantage of the country especially amidst China + 1 sourcing strategy by large importers.

6. Unleashing the potential through governance and compliance

Start-ups, researchers or academia will now have access to an anonymised pool of non-personal India datasets through National Data Governance Policy, helping better solutioning and decision making for kinds of organizations. Also, with Digilocker and Aadhaar as one-stop KYC maintenance system and PAN becoming a single identifier for all digital systems, the ease of doing business for MSMEs increases by leaps and bounds. It will be further easy for FinTechs like Vayana can play up on the drop & go functionality of supply chain finance platform, where the time to onboard, review, underwrite and remit the funds will be further shortened, adding better user experience for all players up to the last mile.

7. Reaching the last mile in a meaningful way

Last mile refers to the particularly vulnerable tribal groups, those in drought-prone areas etc. Certain programs are defined to improve their performance across domains like health, nutrition, education, agriculture, water resources and other basic infrastructure. Investments from private sectors will help reach the last mile faster, improving their standard of living and adding meaning to everyday existence through education and financial inclusion. Large organizations and Start-ups can look at this as an opportunity to bring more workforce into formal wage structures, thus fuelling the growth of the economy. With consumers, technology, government and regulators moving in one direction, it is an opportune time for supply chains to emerge as important lever for modernization and growth in the economy.